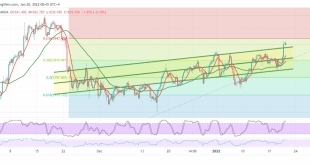

Gold managed to retest the support line of the ascending price channel shown on the chart located at 1825, maintaining the bullish bias and hovering around its highest level during the early trading of the current session 1844. Technically, and carefully looking at the 4-hour chart, we notice the regularity …

Read More »Gold Is Looking For Additional Momentum 25/1/2022

Gold managed to retest the support line of the ascending price channel shown on the chart located at 1825, maintaining the bullish bias and hovering around its highest level during the early trading of the current session 1844. Technically, and carefully looking at the 4-hour chart, we notice the regularity …

Read More »Gold May Witness a Temporary Bearish Slope 21/1/2022

The yellow metal prices found a strong resistance level at 1847, which we mentioned during the previous analysis that breaching it is a basic and important condition to continue the rise. Technically, the intraday movement of gold is witnessing stability below the mentioned resistance. However, by looking at the 4-hour …

Read More »Gold Reverses The Downtrend 20/1/2022

Gold prices achieved noticeable gains and reversed the bearish trend as we expected, in which we relied on trading stability below the 1820 resistance level, recording the highest level at 1844. Technically, trading above the previously breached resistance-into-support at 1820 price supports the possibility of the upside and price movements …

Read More »Gold Gradually Falls to The Down Side 19/1/2022

The movements of the yellow metal witnessed a negative trading session yesterday, and as a reminder, we indicated that we are waiting to confirm the breach of the 1810 level, and this increases the negativity to target 1803 so that gold approaches the required target, recording 1805 Technically, and carefully …

Read More »Gold Forming Pressure on Support 18/1/2022

The yellow metal started the current session’s trading with a bearish tendency after difficulty surpassing the upside and settling above the strong resistance level located at 1826 price, which forced it to move negatively and stable around its lowest level during the early trading of the current session 1816. Today’s …

Read More »Gold Maintains Gains 14/1/2022

The technical outlook remains unchanged, to find that the prices of the yellow metal are trading positively, maintaining the gains that were achieved during this week’s trading, reaching the highest of 1828. Technically, and by looking at the 4-hour chart, we notice the price’s intraday stability above the support level …

Read More »Gold Continues to Rise 13/1/2022

The yellow metal prices consolidated its gains at the expense of the US dollar’s decline, heading to touch the target price station during the last analysis at 1828, recording its highest level at 1828. Technically, and by looking at the 4-hour chart, we notice the price’s intraday stability above the …

Read More »Gold Touches Goals 12/1/2022

Gold prices managed to touch the official target required to be achieved during the previous report, located at 1823, recording its highest level during the last trading session of 1823. Technically, it managed to establish a good support floor around the psychological barrier of 1800, and it also succeeded in …

Read More »Gold Breaks Through The Resistance 11/1/2022

Gold prices started today’s trading session with a noticeable rise after it announced the reliance on the solid support floor located around 1782. The price is now hovering around the highest level during early trading in 1807. On the technical side, we find gold prices succeeded in breaching the pivotal …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations