Gold prices exhibited positive movement in the previous session, attempting to halt the ongoing downward correction and showing temporary stability above 2884. From a technical perspective, despite the bullish momentum observed yesterday, a closer look at the 4-hour chart reveals that the price remains stable above 2868, which corresponds to …

Read More »Gold experiencing negative pressure 3/3/2025

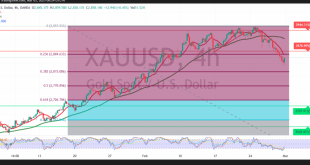

Gold prices suffered heavy losses at the end of last week’s trading amid profit-taking, reaching a low of $2,832 per ounce. From a technical analysis perspective, the 4-hour chart shows clear negative crossover signals on the simple moving averages, reinforced by bearish indications on the 14-day momentum indicator. Given these …

Read More »Gold: Retest Scenario 21/2/2025

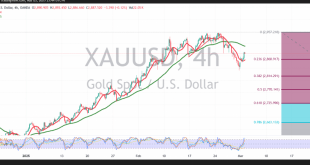

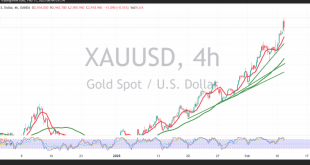

Gold Hits Record Highs Before Facing Profit-Taking Pressure Gold prices extended their rally in the previous trading session, surpassing the key $2,950 per ounce target and reaching a new high of $2,954. Technical Analysis Despite the strong long-term bullish trend, intraday movements indicate a bearish pullback due to profit-taking and …

Read More »Gold tries to regain the upward path 18/2/2025

Gold (XAU/USD) Technical Analysis Gold prices began today’s trading with an upward trend after last Friday’s decline and profit-taking pushed prices down to $2878 per ounce. Technical Outlook: Bullish Signals: The price remains stable above the 50-day simple moving average (SMA). Intraday support is confirmed at 2887, with a broader …

Read More »Gold rests on support 13/2/2025

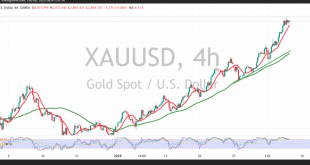

Gold Price Analysis Gold successfully retested the 2870 support level and closed above it, initiating an upward move in today’s session, reaching $2918 per ounce. Technical Outlook: Bullish Indicators: Simple moving averages support the continuation of the upward trend. The 14-day momentum indicator signals positive momentum. Bearish Risk: A drop …

Read More »Gold hits record highs 11/2/2025

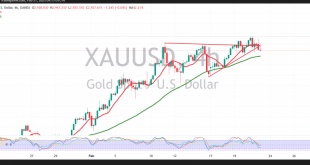

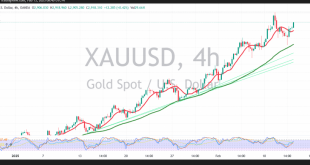

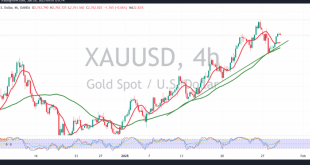

Gold continues to post record highs, extending its longest winning streak since 2020, reaching $2942 per ounce during early trading today. Technical Outlook: The 4-hour chart shows that simple moving averages continue to support an upward trajectory. However, gold is facing resistance at $2942, aligning with the upper boundary of …

Read More »Gold may continue to rise 6/2/2025

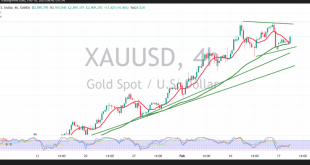

Gold prices successfully reached the target of 2870 in the previous session, recording a new high at $2882 per ounce. Technical Outlook: Moving averages continue to support an upward trend. Gold remains within an ascending price channel, with 2840 acting as a key support level. Key Levels to Watch: Bullish …

Read More »Gold is based on support 30/1/2025

Gold managed to establish strong support above $2740, rebounding higher in the previous session and reaching $2766 per ounce. Technical Outlook: The price remains above the 50-day simple moving average, reinforcing bullish momentum. The Stochastic indicator shows positive signals, suggesting further upside potential. Key Levels to Watch: Above $2770: A …

Read More »Gold continues its rise, Eyes on the Fed 29/1/2025

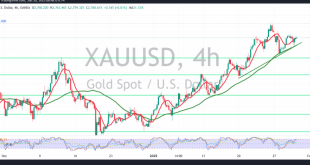

In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that a confirmed breach of the 2755 resistance level could lead to a new upward wave, targeting 2765, with the price reaching a high of $2766 per ounce. From a technical perspective today, the 4-hour …

Read More »Gold is waiting for a signal to move 28/1/2025

Negative trading dominated gold’s movements as anticipated in the previous report, reaching the first target of 2735 and recording its lowest level at $2730 per ounce. Today’s technical outlook suggests the possibility of continuing the downward trend. However, upon closer examination, there appears to be a conflict between technical indicators. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations