Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling Gold prices saw mixed trading in the previous session, briefly approaching the first downside target at $3,112 before …

Read More »Gold breaks through uptrend support line 15/5/2025

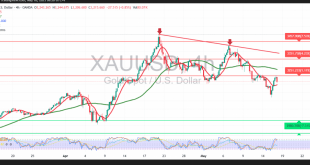

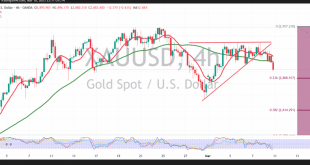

Gold prices declined sharply in the previous session, pressured by profit-taking after strong gains earlier in the year. The market reached key downside targets outlined in the previous report, with prices falling to a low of $3,148 during early trading today. From a technical perspective, the 4-hour chart reveals a …

Read More »Gold continues its meteoric rise 16/4/2025

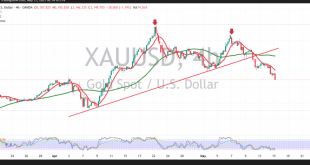

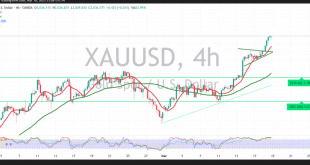

Gold prices continue to surge within the framework of a strong upward trend, as anticipated in previous reports. The metal has successfully reached the official target at $3,274 and recorded a new session high of $3,286 per ounce during early morning trading. On the 4-hour chart, price action remains firmly …

Read More »Gold gets rid of oversold conditions 15/4/2025

The key support level highlighted in the previous technical report at $3,190 successfully held, helping to maintain the broader upward trend. Following a rebound from this level, gold prices have resumed their climb, currently trading around $3,228 per ounce at the time of writing. On the 4-hour chart, price action …

Read More »Gold reaches unprecedented highs 3/4/2025

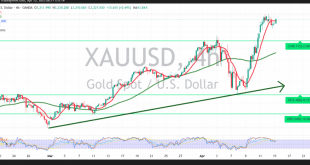

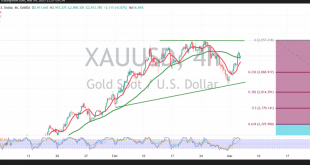

Gold continues its record-breaking rally, reaching $3,167 per ounce during early trading this morning—hitting the official target outlined in the previous technical report. From a technical analysis perspective, the 4-hour chart reflects a strong bullish structure, reinforcing the continuation of the current upward trend. Price action remains comfortably above key …

Read More »Gold continues to record highs, all eyes on Fed 19/3/2025

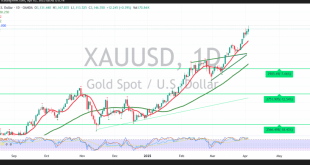

Gold prices continue their record-breaking rally, surpassing the previous peak and setting a new all-time high near $3,038 per ounce, exceeding the projected target of $3,020. From a technical perspective, the 4-hour chart shows that gold remains well-supported by the simple moving averages, which continue to reinforce the upward trend. …

Read More »Gold attacks resistance and needs a positive stimulus 13/3/2025

We previously maintained a neutral stance, emphasizing the need to monitor price behavior around the 2930 resistance level. A confirmed breakout above this level was expected to pave the way for a return to 2940, which was successfully achieved, marking a record high of $2940 per ounce. Technical Analysis On …

Read More »Gold presses support 11/3/2025

During yesterday’s European session, gold traded sideways, confined by the psychological support at 2900 and a pivotal resistance at 2930. On the 4‑hour chart, gold began to test the support floor at 2900 during the previous American session, recording a low of $2880 per ounce. Simple moving averages are now …

Read More »Gold Looks for Trend, Eyes on NFP 7/3/2025

Yesterday, gold experienced a bearish trend, approaching the previously identified support at 2886 and recording a low of 2891. Technical Outlook Chart Patterns: On the 4-hour timeframe, an ascending technical formation resembling an inverted head and shoulders is visible. The simple moving averages continue to support the daily upward trend, …

Read More »Gold achieves the desired goal 5/3/2025

Gold continued its upward trend, in line with our previous outlook. The breach of 2893 acted as a catalyst, pushing prices toward the first target of 2910 and the second target of 2920, with the recent high reaching $2927 per ounce. Technical Outlook Bullish Signals: The Relative Strength Index (RSI) …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations