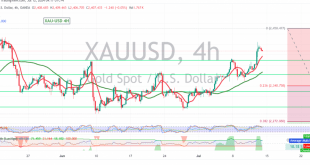

Gold prices have surged significantly, exceeding our previous target of 2400 and reaching a high of $2424 per ounce, confirming the bullish trend we anticipated in our last report. Technical Outlook: Gold prices have successfully consolidated above the psychologically significant 2400 level, with the simple moving averages (SMAs) continuing to …

Read More »Gold: Bullish Bias Persists Amidst Consolidation 10/7/2024

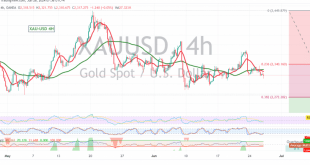

Gold prices nearly reached our previously identified target of 2374, peaking at $2371 per ounce. While a minor pullback occurred due to overbought conditions, the technical outlook remains bullish. Key Technical Signals: Support Holds: The 2350 support level successfully contained the recent bearish pullback.Upward Rebound: The 4-hour chart reveals an …

Read More »Gold: Bullish Bias Persists Despite Recent Pullback 9/7/2024

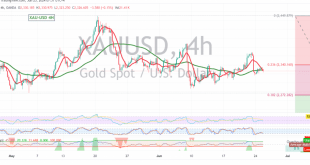

In our previous report, we highlighted potential targets of 2374 and 2388 for gold, which successfully reached a high of $2391 per ounce. While a minor pullback occurred due to overbought conditions, the technical outlook remains bullish. Key Technical Signals: Support Holds: The 2353 support level effectively limited the recent …

Read More »Gold: Bullish Breakout, Upside Potential Ahead 5/7/2024

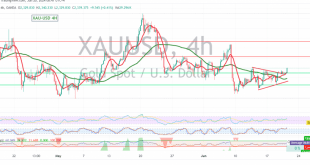

Gold prices have broken out of the previous sideways range, consolidating above the 2340 resistance level (23.60% Fibonacci retracement) as anticipated in our previous analysis. This breakout signals a potential shift in momentum towards a bullish trend. Technical Outlook: On the 4-hour chart, the price is now trading above the …

Read More »Gold: Bearish Bias Holds Amid Sideways Consolidation 3/7/2024

Gold prices continue to trade within a tight range, bounded by the 2317 support level and the 2340 resistance level. Technical Outlook: The technical outlook remains unchanged, with a bearish bias prevailing. The price continues to trade below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart, …

Read More »Gold: Bearish Bias Holds Amid Sideways Consolidation 2/7/2024

Gold prices continue to trade within a tight range, bounded by the 2318 support level and the 2340 resistance level. Technical Outlook: The technical outlook remains bearish, as the price continues to trade below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart. The 50-day simple moving …

Read More »Gold: Bearish Trend Continues, Downside Potential Remains 26/6/2024

Gold prices remain under bearish pressure, continuing the downward trajectory as anticipated in our previous technical report. The price has reached a low of $2310 per ounce, confirming the ongoing downtrend below the pivotal resistance level of 2340. Technical Outlook: The technical outlook remains unchanged, with the price consistently trading …

Read More »Gold: Bearish Bias Persists Amid Sideways Movement 25/6/2024

Gold prices have been trading within a narrow range, bounded by the 2317 support and 2340 resistance levels during the start of the week. Technical Outlook: Our technical analysis suggests a potential continuation of the downward trend. This bearish outlook is supported by the price remaining below the crucial 2340 …

Read More »Gold: Bullish Momentum Emerges After Downward Trend 21/6/2024

Gold prices reversed their previous downward trend and rallied during yesterday’s trading session, surpassing the key resistance level of 2340 and reaching a high of $2365 per ounce. This price action indicates a potential shift in sentiment towards a bullish outlook. Technical Outlook: The technical analysis now suggests a continuation …

Read More »Gold: Bearish Bias Prevails Despite Positive Opening 20/6/2024

Gold prices opened on a positive note today, retesting the pivotal resistance level of 2340. However, the technical outlook remains predominantly bearish. Technical Analysis On the 240-minute chart, while the simple moving averages are now providing support from below, suggesting a potential upward trend, the price remains below the crucial …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations