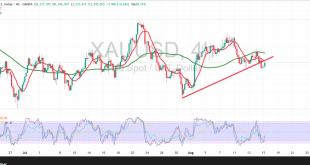

Gold prices (XAU/USD) recorded a sharp decline in the previous session after stronger US inflation data boosted the dollar at the expense of the precious metal, sending prices to a low of $3,329. Technical Outlook – 4-hour timeframe: Intraday price action shows only limited rebound attempts, as the 50-period simple …

Read More »Gold Struggles at Crucial Threshold — Support or Resistance to Give Way? 13/8/2025

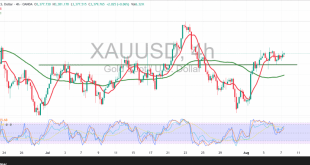

Gold prices (XAU/USD) experienced mixed but predominantly negative movement, reaching their lowest level in the previous session at $3,331 per ounce. Technical Outlook – 4-hour timeframe: During mid-day trading yesterday, gold attempted a modest rebound after the Relative Strength Index (RSI) entered sharp oversold territory, triggering limited upside movement. However, …

Read More »Strong Momentum Pushes Gold Higher — What Lies Beyond $3,400? 8/8/2025

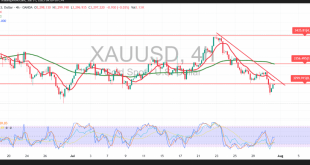

Gold prices extended their strong upward momentum, fully aligned with the positive outlook outlined in our previous report. The metal reached the official bullish targets, climbing to a session high of $3,409 per ounce during early trading. Technical Outlook: After reaching the key psychological resistance at $3,400, gold is showing …

Read More »Gold Gains Persist on Technical Support — All Eyes on $3400 7/8/2025

Gold continues its steady upward movement, maintaining bullish momentum in line with the positive outlook presented in the previous report. The metal has gradually approached the projected target of $3,390, recording a session high of $3,385 per ounce. Technical Outlook: After testing the $3,385 resistance level, gold experienced a brief …

Read More »Is There More Upside for Gold? Technical Indicators in Focus 6/8/2025

Gold prices have continued their upward trajectory, in full alignment with the bullish expectations outlined in our previous report. The metal successfully reached the projected target at $3,390, recording a session high at that level. Technical Outlook: Following the test of the $3,390 resistance zone, prices experienced a mild intraday …

Read More »Gold Loses Steam as Markets Brace for NFP Report 1/8/2025

Gold is making limited attempts to recover recent losses; however, these efforts are currently facing strong technical resistance near the $3,315 per ounce level. Technical Outlook: The price is consolidating just below this key resistance area. On the chart, the 50-period Simple Moving Average (SMA) and shorter moving averages continue …

Read More »Positive Signals Emerge, but Gold’s Overall Trend Remains Bearish 31/7/2025

Gold prices recorded sharp losses in yesterday’s session, aligning with the bearish outlook outlined in our previous report. As anticipated, the break below the $3,308 support level accelerated the decline, with the price reaching $3,297 and $3,285 before marking a session low at $3,268 per ounce. Technical Outlook: The metal …

Read More »Bearish Technical Signals Surround Gold 30/7/2025

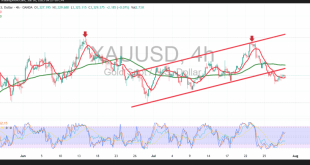

Gold prices are currently trading within a rangebound pattern, stabilizing above the strong support level at $3,310 while facing key resistance near $3,334. Technical Outlook: Price action shows limited bullish momentum following a rebound from the important psychological level at $3,300. However, the upside remains capped by the 50-period Simple …

Read More »Gold Exits Bullish Path — Is It a Pullback or a Trend Reversal? 29/7/2025

Gold prices registered a notable decline at the start of this week’s trading session, driven largely by profit-taking activity, with the price reaching a low of $3,301 per ounce. Technical Outlook: Intraday price action is showing a modest rebound as gold tests the key psychological support level at $3,300. This …

Read More »Will Overbought Conditions Slow Gold’s Bullish Momentum? 23/7/2025

Gold prices extended their gains for the third consecutive session, in line with the bullish expectations outlined in previous reports. The metal reached the official target at $3,435, recording an intraday high of $3,439 per ounce. Technical Outlook – 4-Hour Timeframe: Intraday movement shows a slight pullback, driven by a …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations