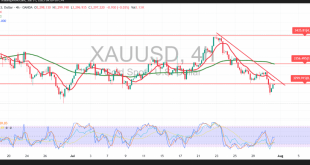

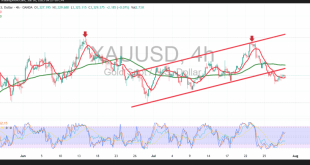

Gold prices recorded sharp losses in yesterday’s session, aligning with the bearish outlook outlined in our previous report. As anticipated, the break below the $3,308 support level accelerated the decline, with the price reaching $3,297 and $3,285 before marking a session low at $3,268 per ounce. Technical Outlook: The metal …

Read More »Bearish Technical Signals Surround Gold 30/7/2025

Gold prices are currently trading within a rangebound pattern, stabilizing above the strong support level at $3,310 while facing key resistance near $3,334. Technical Outlook: Price action shows limited bullish momentum following a rebound from the important psychological level at $3,300. However, the upside remains capped by the 50-period Simple …

Read More »Gold Exits Bullish Path — Is It a Pullback or a Trend Reversal? 29/7/2025

Gold prices registered a notable decline at the start of this week’s trading session, driven largely by profit-taking activity, with the price reaching a low of $3,301 per ounce. Technical Outlook: Intraday price action is showing a modest rebound as gold tests the key psychological support level at $3,300. This …

Read More »Gold Prices Dip as U.S.-Japan Trade Deal Eases Risk Concerns, But Market Uncertainty Persists

Gold prices experienced a slight pullback on Wednesday, retreating marginally from the strong gains seen earlier this week. The dip was influenced by the announcement of a trade deal between the U.S. and Japan, which helped boost risk appetite and dampened the demand for safe-haven assets like gold. At 01:20 …

Read More »Will Overbought Conditions Slow Gold’s Bullish Momentum? 23/7/2025

Gold prices extended their gains for the third consecutive session, in line with the bullish expectations outlined in previous reports. The metal reached the official target at $3,435, recording an intraday high of $3,439 per ounce. Technical Outlook – 4-Hour Timeframe: Intraday movement shows a slight pullback, driven by a …

Read More »Gold Surges Past $3,400 as Trade Tensions and Fed Concerns Boost Safe-Haven Appeal

Gold (XAU/USD) is climbing on Tuesday, July 22, 2025, breaking the $3,400 mark with a near 1% gain by 2:57 PM EEST, driven by escalating trade disputes and doubts over the Federal Reserve’s autonomy. This rally sparks a key question—can gold maintain its upward trajectory, or will competing assets cap …

Read More »Gold Breaks Above $3400 Before Easing on Profit-Taking 22/7/2025

Gold prices posted a strong rally in the previous trading session, aligning with the bullish expectations outlined in the latest technical report. The metal surpassed the target level of $3,376, reaching as high as $3,402 per ounce during early trading today. Technical Outlook – 4-Hour Timeframe: Intraday price action shows …

Read More »Gold holds above key support amid technical upside attempts 18/7/2025

Gold prices exhibited mixed but upward-biased movement, with the metal maintaining its position above the pivotal support area at $3,310, preserving a positive short-term outlook. Technical Outlook – 4-Hour Timeframe: Intraday price action reflects a continuation of the bullish trend, following a solid bounce from $3,310. This support level allowed …

Read More »Gold Looks to Rebound against Dollar 16/7/2025

Gold prices experienced significant volatility during yesterday’s session, following the release of U.S. inflation data that strengthened the dollar and exerted downward pressure on gold. As noted in our previous report, a break below $3,340 reactivated the bearish scenario, which materialized after gold dipped to $3,320. Technical Outlook – 4-Hour …

Read More »Gold Rises on Robust Demand Ahead of Key Inflation Figures 15/7/2025

Gold began the week with strong upward momentum, reaching its highest level in three weeks at $3,375 per ounce. This move aligns with the bullish scenario outlined in the previous technical report, which identified $3,360 as the initial resistance target. Technical Outlook – 4-Hour Timeframe: Gold has established a solid …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations