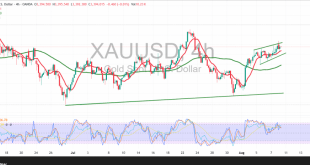

Gold prices attempted a bullish rebound during the previous trading session, but gains remained limited after they hit the pivotal resistance level of 3355, which successfully curbed the upward momentum and stopped the positive thrust. Technical Outlook – 4-Hour Timeframe Intraday movements are trending downward, retesting the support level of …

Read More »50-Day Moving Average Halts Gold’s Rise – 21/08/2025

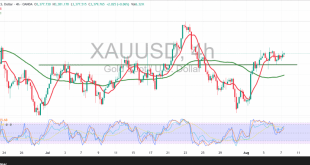

Gold prices (XAU/USD) saw an upward rebound yesterday, benefiting from touching the 3310 support level to reverse the expected downward trend from the previous report. That report was based on the price remaining stable below the 3340 resistance level, noting that a break of 3340 might open the way for …

Read More »Weak Upward Momentum Leaves Gold Under Sellers’ Control 20/08/2025

Gold prices (XAU/USD) saw a sharp decline during the previous trading session, continuing the movement anticipated in our last technical report. Prices have already touched the target level of $3310.Technical Outlook – 4-Hour Timeframe Gold prices are trading below the major support level around 3325, which was broken during the …

Read More »Gold Slips as Dollar Strength 15/8/2025

Gold prices (XAU/USD) recorded a sharp decline in the previous session after stronger US inflation data boosted the dollar at the expense of the precious metal, sending prices to a low of $3,329. Technical Outlook – 4-hour timeframe: Intraday price action shows only limited rebound attempts, as the 50-period simple …

Read More »Gold Struggles at Crucial Threshold — Support or Resistance to Give Way? 13/8/2025

Gold prices (XAU/USD) experienced mixed but predominantly negative movement, reaching their lowest level in the previous session at $3,331 per ounce. Technical Outlook – 4-hour timeframe: During mid-day trading yesterday, gold attempted a modest rebound after the Relative Strength Index (RSI) entered sharp oversold territory, triggering limited upside movement. However, …

Read More »Strong Momentum Pushes Gold Higher — What Lies Beyond $3,400? 8/8/2025

Gold prices extended their strong upward momentum, fully aligned with the positive outlook outlined in our previous report. The metal reached the official bullish targets, climbing to a session high of $3,409 per ounce during early trading. Technical Outlook: After reaching the key psychological resistance at $3,400, gold is showing …

Read More »Gold Gains Persist on Technical Support — All Eyes on $3400 7/8/2025

Gold continues its steady upward movement, maintaining bullish momentum in line with the positive outlook presented in the previous report. The metal has gradually approached the projected target of $3,390, recording a session high of $3,385 per ounce. Technical Outlook: After testing the $3,385 resistance level, gold experienced a brief …

Read More »Is There More Upside for Gold? Technical Indicators in Focus 6/8/2025

Gold prices have continued their upward trajectory, in full alignment with the bullish expectations outlined in our previous report. The metal successfully reached the projected target at $3,390, recording a session high at that level. Technical Outlook: Following the test of the $3,390 resistance zone, prices experienced a mild intraday …

Read More »Weekly market wrap: Jobs data and Fed at the centre of attention

The trading week ending July 29 was marked by significant market-moving events, most notably the Federal Reserve meeting, labor market and inflation data, U.S. economic growth figures, and developments in the Trump administration’s trade policy. The Federal Reserve opted to keep interest rates unchanged last Wednesday, while signaling a continued …

Read More »Gold Loses Steam as Markets Brace for NFP Report 1/8/2025

Gold is making limited attempts to recover recent losses; however, these efforts are currently facing strong technical resistance near the $3,315 per ounce level. Technical Outlook: The price is consolidating just below this key resistance area. On the chart, the 50-period Simple Moving Average (SMA) and shorter moving averages continue …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations