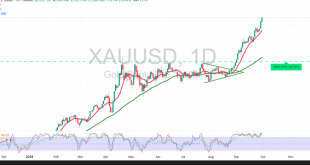

Gold successfully completed the corrective decline highlighted in the previous report, reaching $3,793, before resuming its upward trajectory and recording a new session high at $3,875 in early trading today. Technical Outlook: Trend: The overall bias remains bullish after the completion of the initial correction wave. 50-period SMA: Price continues …

Read More »Gold Surges Again: Can XAU/USD Keep Rising? 30/9/2025

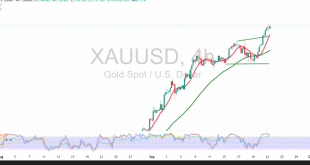

Gold (XAU-USD) prices continued their sharp rise during the morning trading session, recording a high of $3,867. Technical Outlook – 4-Hour Timeframe: Price action remains supported by stability above the simple moving averages, which act as dynamic support, reinforcing the upward trend. The bullish trend clearly dominates, with buying momentum …

Read More »Gold Pushes to Fresh Record Highs Amid Fed Uncertainty

Gold prices climbed to new records in Asian trading on Tuesday, supported by safe-haven demand as cautious comments from Federal Reserve officials tempered expectations for aggressive interest rate cuts. Haven Flows Drive Gold Higher Spot gold surged to an all-time high of $3,759.18/oz, while gold futures touched $3,794.82/oz. Risk aversion …

Read More »Gold Hits Fresh Highs — Is $3,800 Next? 23/9/2025

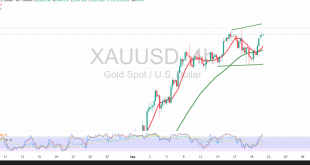

Gold extended its rally during the European session, recording a high of $3,759 per ounce, surpassing the previously mentioned $3,720 resistance. Technical Outlook: Simple Moving Averages (SMA): Price action remains supported above the moving averages, which act as dynamic support reinforcing the bullish structure. Relative Strength Index (RSI): Approaching overbought …

Read More »Gold Prices Stay Near Record Highs as Investors Bet on Further Fed Easing

Gold prices gained modestly in Asian trading on Monday, holding close to last week’s all-time peaks as expectations of further U.S. interest rate cuts supported the bullion market. Spot gold rose 0.3% to $3,697.70 an ounce by 01:33 ET (05:33 GMT), while U.S. gold futures climbed 0.7% to $3,733.10 per …

Read More »Gold Holds Its Uptrend Despite Overbought Pressure! 22/9/2025

Gold opened the session with an upward bias, recording a daily high of $3,697 per ounce, supported by favorable technical factors. Technical Outlook:Price action remains underpinned by stability above the simple moving averages, which continue to act as dynamic support for the uptrend. However, the Relative Strength Index (RSI) has …

Read More »Gold Holds Firm After Fed Rate Cut Despite Dollar Rebound

Market OverviewGold prices traded modestly higher in Asian trading on Friday, remaining close to record peaks and on track for a fifth straight weekly gain. Spot gold rose 0.2% to $3,650.14 per ounce, while U.S. gold futures for December delivery added 0.2% to $3,683.70. The metal had touched a historic …

Read More »Gold Retreats from Record Highs as Fed’s Cautious Easing Lifts Dollar

Gold prices slipped in Asian trade on Thursday, retreating from fresh record peaks after the Federal Reserve cut interest rates but signaled a measured approach to future easing, helping the U.S. dollar rebound. Spot and Futures Weaken After Fed Decision Spot gold fell 0.7% to $3,635.55 an ounce by 02:24 …

Read More »Gold Pulls Back Slightly Ahead of Fed Decision

Gold prices slipped from record highs in Asian trading on Wednesday as investors turned cautious ahead of the U.S. Federal Reserve’s policy meeting later in the day. Spot Gold fell 0.4% to $3,673.38/oz by 02:40 ET (06:40 GMT), after touching a new all-time high of $3,702.95/oz on Tuesday. Gold Futures …

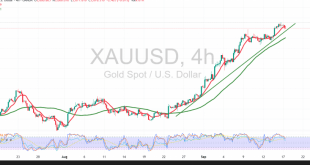

Read More »Critical Levels Define Gold’s Direction as Markets Await the Fed! 17/9/2025

Gold (XAU/USD) Technical Analysis – 4H Chart Gold prices extended their bullish momentum in the last session, reaching the first target at $3,705 and printing a session high of $3,703 per ounce, setting a fresh all-time record. Technical Outlook: After touching the $3,700 psychological barrier, intraday price action showed a …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations