Gold extended its decline in the prior session, in line with the bearish view, approaching the projected $3,985 target and printing a low at $3,963. Technical outlook Price remains below the 50/100 SMA cluster on H4, keeping moving averages as dynamic resistance and capping rebound attempts. The ascending trendline has …

Read More »Freefall in Gold — Is This the Start of a Major Correction? 22/10/2025

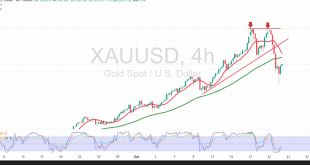

Gold (XAU/USD) sold off sharply after failing to reclaim the $4,380 pivot, in line with the prior bearish bias. The drop forced a retest of $4,245 and extended to a $4,005 low before stabilizing. Technical:A clear double-top has formed, reinforcing short-term seller control. Price holds below down-sloping SMAs, which are …

Read More »Gold Poised Between Rock-Solid Support and Pivotal Resistance 21/10/2025

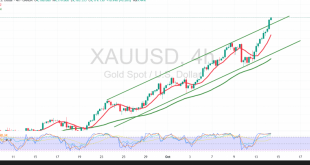

In the prior note we flagged indecision and said an hourly close above 4,280 would confirm bullish continuation toward 4,350. Since then, gold has held above 4,245, turning that area into a key support while price compresses beneath nearby resistance. Technical (4H):Price action is clearly above 4,245, reinforcing role-reversal support …

Read More »Gold Between Firm Support and Pivotal Resistance — Break or Bounce 20/10/2025

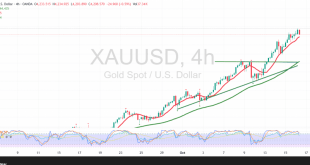

Gold (XAU/USD) swung sharply on Friday, spiking to $4,380 before retreating to a $4,185 low into the close. The tape remains choppy but underpinned by safe-haven demand. Technical (4H):Price is holding above $4,200, which has flipped into key support and provides a firm floor against deeper pullbacks. Up-sloping SMAs confirm …

Read More »Gold Prices Surge as Bullish Momentum Reignites 16/10/2025

Gold (XAU/USD) extended its record-setting run in early trade, printing a new all-time high at $4,242/oz on firm safe-haven demand. Price action is holding above $4,155 and well above the $4,000 psychological pivot, confirming role-reversal support. Up-sloping simple moving averages keep bullish momentum intact, while RSI has cooled from overbought …

Read More »Gold: Temporary Reversal or Sustained Momentum? 14/10/2025

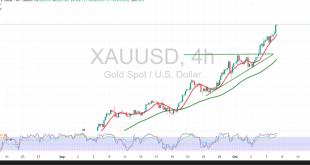

Gold prices continue to post sharp consecutive gains, extending the strong bullish trend and marking a new record high at $4,180 per ounce at the time of writing. The move is supported by increased demand for safe-haven assets amid persistent market uncertainty. Technical Overview The price has successfully stabilized above …

Read More »Gold in Transition: Correction or Continuation? 10/10/2025

Gold prices retreated after reaching a new all-time high near $4,058 per ounce, as profit-taking prompted a pullback that pushed the metal to stabilize below the $4,000 psychological barrier. Technical Overview The metal found short-term support around $3,945, allowing a mild rebound toward $3,975. The simple moving averages continue to …

Read More »Gold’s Rally Knows No Pause 8/10/2025

Gold (XAU/USD) continues to advance strongly, setting fresh all-time highs and reinforcing the prevailing bullish momentum. The metal reached a new record of $4,030 per ounce at the time of writing, driven by sustained buying activity and investor demand for safe-haven assets amid global uncertainty. Technical Outlook – 4-Hour Timeframe: …

Read More »Unstoppable Bullish Momentum — Is Gold Heading Toward $4,000? 6/10/2025

Gold prices continue to reach new record highs, starting the week with sharp gains during Asian trading, touching $3,933 per ounce. Technical Overview: 50-Day Simple Moving Average (SMA): The price remains firmly above this level, providing dynamic support that continues to strengthen the bullish momentum. Relative Strength Index (RSI): Despite …

Read More »Spotlight on Gold: Profit Booking or Structural Decline? 3/10/2025

After reaching a record high of $3,897, gold prices faced heavy profit-taking, retreating to $3,819 before attempting to stabilize. Technical Outlook: 50-day SMA: Price action remains supported above the moving average, preserving the broader bullish structure. RSI: Currently sending negative signals, reflecting weaker momentum and creating intraday volatility. Trend Bias: …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations