Despite Monday’s strong US dollar, gold prices managed to recover some of the losses from last week, rising by more than 0.5%. Following Friday’s US Nonfarm Payrolls report, which showed a robust labour market with 272,000 jobs gained beyond estimates, gold is rising. On the other hand, future US inflation …

Read More »Gold returns to the downward correction 10/6/2024

Gold prices experienced a sharp decline, surrendering recent gains due to a strengthening U.S. dollar following the release of strong U.S. jobs data last Friday. The precious metal, which previously struggled to break above the 2360 resistance level, has now fallen below the crucial 2318 support, reaching a low of …

Read More »Gold hits two-week high ahead of NFP data

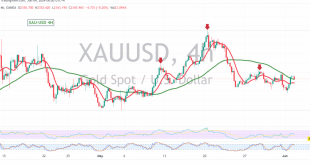

Gold reached a two-week high of $2,378 on Thursday following weaker-than-expected jobs data announced by the US Bureau of Labor Statistics (BLS). The BLS report had a significant impact on US Treasury bond yields, which remained virtually unchanged, providing a tailwind for the precious metal. As a result, the XAU/USD …

Read More »Gold is looking for a stronger direction 5/6/2024

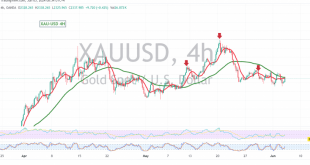

The technical landscape for gold remains largely unchanged, with the precious metal holding above the 2318 support level but facing resistance from the 50-day simple moving average. Despite yesterday’s upward movement, the 50-day simple moving average continues to exert downward pressure on the price. Additionally, the Stochastic oscillator is showing …

Read More »Gold Prices Face Key Resistance Level Amidst Mixed Signals 4/6/2024

Gold prices experienced positive momentum yesterday, approaching the significant resistance level of 2340 and reaching an intraday high of $2354.00 per ounce. However, the technical outlook presents a mixed picture, with both bullish and bearish signals vying for dominance. On the 4-hour timeframe chart, the 50-day simple moving average is …

Read More »Market Drivers; US Session, May 30

The US Dollar experienced a corrective movement on Thursday, which helped the risk complex recover some ground before the release of the US PCE and advanced inflation data for the euro area, which are all scheduled for Friday.CurrenciesThe USD Index (DXY) came under pressure and retreated from weekly highs past …

Read More »Gold Prices Face Downward Pressure 30/5/2024

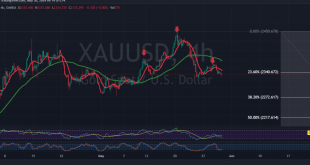

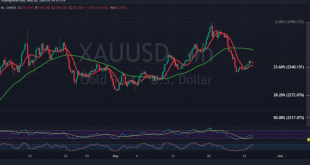

Gold prices have reversed their previously expected upward trajectory, breaking below the critical 2340 support level as outlined in the previous technical report. This development has initiated a bearish turn in the market, with prices currently trading below the 23.60% Fibonacci retracement level on the 4-hour timeframe chart. Further technical …

Read More »Gold building on support 28/5/2024

Gold Prices Poised for Further Upside, Technical Analysis Suggests Gold prices have found solid footing at the 2340 support level, as highlighted in the previous technical report. This support, coinciding with the 23.60% Fibonacci retracement level on the 240-minute timeframe chart, successfully halted the recent downward trend and propelled prices …

Read More »Gold Prices Surge on Positive Technical Outlook 28/5/2024

Gold prices experienced a significant boost in early trading this week, solidifying their position above the key psychological resistance level of $2400 per ounce. Previous technical analysis highlighted the potential for a direct recovery towards $2330 once prices held above $2295, a prediction validated by gold’s recent peak of $2358. …

Read More »Market Drivers – US Session, May 28

Bitcoin closed on an upward trajectory, driven by news of collaboration between Argentina’s Securities and Exchange Commission and El Salvador. The two countries are exploring further adoption of cryptocurrencies. BTC’s global spread closed at $69,528 per unit, slightly higher than the previous day’s closing price of $68,489. However, the larger-cap …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations