The financial markets have been wildly volatile this week, with notable swings in the price of gold, Bitcoin, and the British pound (GBP) caused by a variety of circumstances. Let’s examine the main forces at work in their performance and look forward.Dynamic Interplay The complex interplay among economic data, expectations …

Read More »Gold: Bullish Bias Persists Amidst Consolidation 10/7/2024

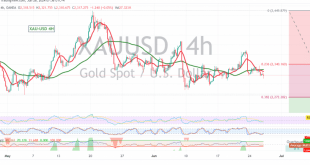

Gold prices nearly reached our previously identified target of 2374, peaking at $2371 per ounce. While a minor pullback occurred due to overbought conditions, the technical outlook remains bullish. Key Technical Signals: Support Holds: The 2350 support level successfully contained the recent bearish pullback.Upward Rebound: The 4-hour chart reveals an …

Read More »Gold: Bullish Bias Persists Despite Recent Pullback 9/7/2024

In our previous report, we highlighted potential targets of 2374 and 2388 for gold, which successfully reached a high of $2391 per ounce. While a minor pullback occurred due to overbought conditions, the technical outlook remains bullish. Key Technical Signals: Support Holds: The 2353 support level effectively limited the recent …

Read More »Gold: Bullish Breakout, Upside Potential Ahead 5/7/2024

Gold prices have broken out of the previous sideways range, consolidating above the 2340 resistance level (23.60% Fibonacci retracement) as anticipated in our previous analysis. This breakout signals a potential shift in momentum towards a bullish trend. Technical Outlook: On the 4-hour chart, the price is now trading above the …

Read More »Gold Steady at 10-Day High Amid Rate Cut Bets, Nonfarm Payrolls Awaited

Gold prices held firm near a 10-day peak in Asian trading on Thursday, buoyed by increasing expectations of interest rate cuts by the Federal Reserve, which weakened the dollar and Treasury yields. However, the precious metal’s gains were tempered by hawkish signals from the Fed’s June meeting minutes and cautious …

Read More »Gold Prices Soar Following Soft US Data

Gold prices surged over 1% on Wednesday due to weak US economic data and rising Fed rate cut expectations. The latest FOMC meeting minutes showed that “several participants” were ready to lift rates if inflation remained elevated. The Institute for Supply Management (ISM) shows contracting US services activity, while labor …

Read More »Gold: Bearish Bias Holds Amid Sideways Consolidation 3/7/2024

Gold prices continue to trade within a tight range, bounded by the 2317 support level and the 2340 resistance level. Technical Outlook: The technical outlook remains unchanged, with a bearish bias prevailing. The price continues to trade below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart, …

Read More »Gold: Bearish Bias Holds Amid Sideways Consolidation 2/7/2024

Gold prices continue to trade within a tight range, bounded by the 2318 support level and the 2340 resistance level. Technical Outlook: The technical outlook remains bearish, as the price continues to trade below the crucial 2340 resistance level (23.60% Fibonacci retracement) on the 240-minute chart. The 50-day simple moving …

Read More »Gold: Bearish Trend Continues, Downside Potential Remains 26/6/2024

Gold prices remain under bearish pressure, continuing the downward trajectory as anticipated in our previous technical report. The price has reached a low of $2310 per ounce, confirming the ongoing downtrend below the pivotal resistance level of 2340. Technical Outlook: The technical outlook remains unchanged, with the price consistently trading …

Read More »Gold Prices Dip Amid Dollar Strength and Inflation Watch

Gold prices retreated in Asian trade on Tuesday, remaining within a narrow band around the low $2,300s as a resilient dollar and anticipation of key U.S. inflation data dampened investor appetite for the precious metal. Despite a slight overnight dip in the dollar, the greenback held its ground, buoyed by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations