Despite a little decline in US Treasury yields, the USD Index saw some gains and returned to the 104.50 region. The preliminary S&P Global Manufacturing and Services PMIs and advanced goods trade balance are due on July 24, with new home sales coming in second. In addition to continuing Monday’s …

Read More »US yields, Fed rate cut bets push XAU/USD higher

Gold prices have risen above $2,400, ending a four-day losing streak due to falling US Treasury yields. Market players are awaiting crucial economic data, including June’s inflation and Q2 GDP, to gauge the Fed’s next move. India’s import tax cut on gold and silver has also boosted retail demand, supporting …

Read More »Gold: Bearish Momentum Builds, Further Downside Anticipated 23/7/2024

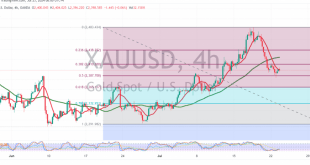

Gold prices have experienced a downward trend, retreating from the recent historical peak of $2483. The technical outlook suggests a continuation of this corrective movement. Technical Outlook: On the 4-hour chart, the simple moving averages (SMAs) have formed a negative crossover, indicating increased selling pressure. Moreover, the price remains below …

Read More »Gold: Strong Bullish Momentum Continues, New Historical Highs in Sight 18/7/2024

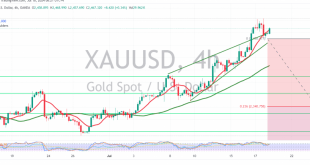

Gold prices reached new historical highs in the previous trading session, surpassing our target of 2450 and reaching a peak of $2483 per ounce, validating our bullish outlook. Technical Outlook: The technical outlook remains strongly bullish. The price has successfully consolidated above the previously breached resistance level of 2450, which …

Read More »Market Drivers; US Session, July 17

The US Dollar declined to new four-month lows due to additional foreign exchange (FX) intervention by the Bank of Japan (BoJ), stronger expectations of rate cuts, and improved sentiment in risk-related assets.On Thursday, the European Central Bank (ECB) is likely to keep its policy rates unchanged, with investors closely monitoring …

Read More »XAU/USD retreats despite Fed rate cut expectations

Gold prices have fallen to $2,457 after reaching an all-time high of $2,483 because of profit-taking. Fed officials, led by Governor Christopher Waller, signal potential rate cuts, suggesting a downward trend for the Fed funds rate. The US Dollar Index drops to 103.72, its lowest level since March 2024, while …

Read More »Gold: Bullish Trend Continues, Eyes on Previous Highs 16/7/2024

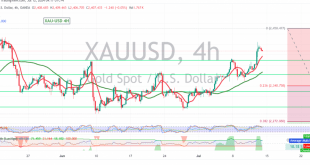

Gold prices maintain their upward momentum, successfully consolidating above the key psychological level of 2400 and reaching a high of $2439 per ounce, surpassing our previous target of 2434. Technical Outlook: The technical outlook remains strongly bullish. The price is holding above the 2400 support level, and the simple moving …

Read More »Noor Capital | Mohammed Hashad Analyzes Market Reactions to Powell’s Testimony

Mohammed Hashad, Head of Research at Noor Capital and a member of the American Society of Technical Analysts, dissected Jerome Powell’s recent testimony before the US House of Representatives. Hashad highlighted a shift in the Fed’s approach, prioritizing both inflation control and labor market health for a balanced economic recovery. …

Read More »Gold: Strong Bullish Momentum, New Highs in Sight 12/7/2024

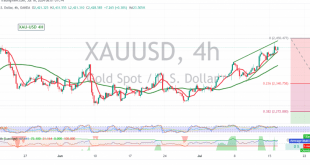

Gold prices have surged significantly, exceeding our previous target of 2400 and reaching a high of $2424 per ounce, confirming the bullish trend we anticipated in our last report. Technical Outlook: Gold prices have successfully consolidated above the psychologically significant 2400 level, with the simple moving averages (SMAs) continuing to …

Read More »Market Drivers; US Session: Focus on US Data, Potential Rate Cuts

US Dollar Dives on Soft US Inflation: The US Dollar Index (DXY) plunged to multi-week lows around 104.00 after disappointing Consumer Price Index (CPI) data and falling US yields. This data fueled speculation of the Federal Reserve cutting interest rates as early as September, sending the Dollar tumbling. Today (July …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations