Gold prices edged lower in Asian trade on Tuesday, as traders awaited crucial U.S. inflation data to gauge the Federal Reserve’s stance on potential interest rate cuts. Spot gold dipped 0.1% to $2,502.07 an ounce, while December gold futures also fell 0.1% to $2,531.0 an ounce. Despite the slight decline, …

Read More »Market Drivers; US Session, September 5

The US dollar continued its downward trend, breaching the crucial 101.00 level. This decline was fueled by persistently low US interest rates and growing speculation that the Federal Reserve might implement a more aggressive interest rate cut, potentially halving the cut in its next meeting.The US Dollar Index (DXY) extended …

Read More »Gold needs extra momentum 5/9/2024

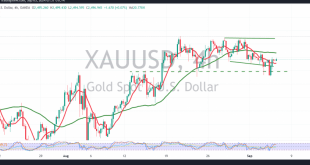

Gold prices saw positive attempts within the expected upward trend mentioned in the previous report, reaching a high of around $2,500 per ounce. From a technical standpoint today, after achieving the official target of $2,470 earlier this week, we note that the price has stabilized above this level, encouraging clear …

Read More »Gold touches targets and tries to recover 4/9/2024

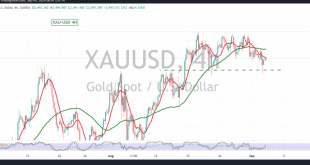

Gold prices suffered significant losses yesterday, as anticipated in our previous technical report, reaching the key levels of 2486 and then 2470, with a low of $2473 per ounce. From a technical standpoint today, we observe that gold has momentarily stabilized above 2486 and generally above 2476. A closer look …

Read More »Gold faces selling pressure 3/9/2024

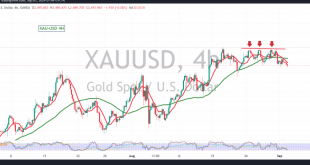

Gold prices experienced a mild downward trend during the previous trading session, attempting to stabilize above the psychological resistance level of 2500, but ultimately closed the day below this threshold. From a technical standpoint, the price is under selling pressure, largely due to its position below the 50-day simple moving …

Read More »Post-Labour Day Market Outlook: US Data Takes the Lead

As the financial markets navigate the post-Labor Day landscape, the upcoming economic data releases from the United States will be a key determinant of market direction. Investors should closely monitor these reports for insights into the health of the US economy and the potential implications for monetary policy.A Data-Driven Week …

Read More »Gold Prices Climb in Asian Trade, Near Record Highs as Inflation Data Looms

Gold prices rose in Asian trading on Thursday, edging closer to record highs as the U.S. dollar’s rebound cooled ahead of key inflation data. The yellow metal also benefited from safe haven demand, which was bolstered by disappointing earnings from NVIDIA Corporation (NASDAQ:NVDA) that shook global equity markets. Gold Holds …

Read More »Gold Prices Slip as Stronger Dollar and Inflation Uncertainty Weigh on Markets

Gold prices fell on Wednesday, pressured by a stronger U.S. dollar and growing uncertainty ahead of a crucial U.S. inflation report that could influence the Federal Reserve’s decisions at its September policy meeting. Gold Slips But Holds Key Level Spot gold dropped 0.6% to $2,510.39 an ounce by 0953 GMT, …

Read More »US dollar weakened against gold and European currencies

The US dollar continued its downward trajectory on Tuesday, succumbing to pressure from rising risk appetite and mounting expectations of a Federal Reserve interest rate cut. The greenback closed lower against a basket of major currencies, including the euro and the pound, as investors flocked to riskier assets. The Federal …

Read More »US bond yields continue to rise

US Treasury yields have continued to climb since the open, driven by market optimism following a series of positive economic data releases. Additionally, markets are eagerly awaiting the release of the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index, later this week. The yield on the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations