The US dollar continued to rise and hit new three-week highs, supported by growing US rates and an ongoing risk-on attitude in reaction to escalating Middle East tensions. The US Dollar Index (DXY) surged to all-time highs of over 101.70 as a result of the ongoing risk aversion and growing …

Read More »Gold continues to pressure support 1/10/2024

Gold prices declined during the previous trading session after failing to maintain stability above the 2645 support level, moving toward the first official target of $2624 per ounce. Today’s technical analysis indicates a likelihood of continuing the corrective decline. A closer look at the 4-hour chart reveals that the simple …

Read More »Market Drivers; US Session, September 30

For the second day in a row, the price of gold declines as month-end flows favor the US dollar despite declining US Treasury yields. However, September is expected to be the strongest month for the golden metal since March 2024, when prices increased by more than 9%. Monthly gains of …

Read More »Financial Markets Weekly Recap: US Data supports Fed’s inclination to more aggressive rate cut

Last week, risk assets and gold emerged as the clear winners over the dollar in the financial markets race. This was fueled by recent economic data releases from the United States, which reinforced the perception of price stability and strengthened the likelihood of continued interest rate cuts by the Federal …

Read More »Gold: New highs today? 27/9/2024

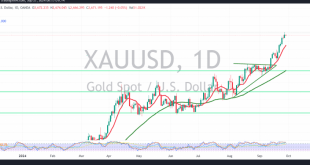

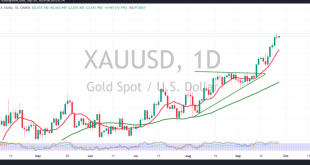

Gold prices continue to reach new historical peaks for the fifth consecutive session, hitting the first target indicated in the previous technical report at 2681, and recording a high of $2685 per ounce. From a technical analysis perspective today, and by examining the 4-hour chart, gold has established a minor …

Read More »Gold may get more positive signals 26/9/2024

Gold prices continued to reach record highs for the fourth consecutive session, hitting a new peak during the previous trading session at $2,671.00 per ounce. From a technical analysis perspective today, and looking at the 4-hour chart, gold displayed some bearish bias, retesting the previously breached resistance near $2,650. The …

Read More »Gold Price Stabilizes Amidst Rising US Treasury Yields

Gold prices have shown resilience despite rising US Treasury yields, maintaining a steady position above $2,650. The market’s increased expectation of further interest rate cuts by the Federal Reserve (Fed) has provided support to the precious metal. However, the strengthening US dollar and elevated Treasury yields have limited gold’s upside.Factors …

Read More »Gold Prices Hit Record Highs Amid Fed Rate Cut Optimism; Copper Rallies on Chinese Stimulus Measures

Gold prices surged to record highs in Asian trading on Tuesday, building on recent gains driven by optimism over U.S. interest rate cuts, while copper prices rallied sharply following a wave of stimulus measures announced by the Chinese government. These developments are setting the stage for a dynamic week in …

Read More »Gold Prices Hit Record High Amid U.S. Rate Cut Optimism, Market Awaits More Economic Signals

Gold prices surged to a new record high in Asian trading, fueled by optimism surrounding recent U.S. interest rate cuts. Investors also exhibited caution ahead of a series of economic events this week, which further supported the yellow metal’s rise. Spot gold climbed 0.3% to reach a historic high of …

Read More »Gold Prices Rise as Dollar Slips After Fed Rate Cut, Markets Eye Further Reductions

Gold prices edged higher in Asian trading on Friday, supported by a weaker dollar following the Federal Reserve’s aggressive interest rate cut. The move has bolstered optimism for more rate reductions, driving demand for the precious metal as a hedge against currency weakness and economic uncertainty. Gold Reacts to Fed’s …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations