Gold, the timeless safe haven, has been on a dazzling run this year. However, recent market trends suggest a potential pause in its upward trajectory. As U.S. Treasury yields rise and the dollar strengthens, gold’s allure as a safe-haven asset may diminish.Tug-of-War Between Bulls and BearsThe Federal Reserve’s monetary policy …

Read More »Gold hits new historic highs 18/10/2024

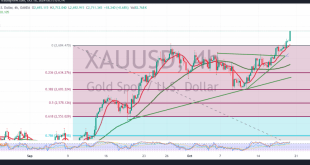

Gold prices reached a new record high of $2712 per ounce, aligning with the upward momentum highlighted in the previous analysis. The breach of the 2685 level led to the anticipated new highs of 2691 and 2700. Technical Outlook:The technical indicators suggest continued bullish momentum, with the simple moving averages …

Read More »Gold hovers around the top 17/10/2024

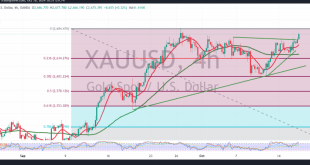

Gold prices are currently hovering around the historical peak of $2685 per ounce but have not yet managed to break through this level, leading to some declines during the previous trading session. Technical Analysis: The simple moving averages continue to support the possibility of an upward move, with the 14-day …

Read More »Gold achieves goals 16/10/2024

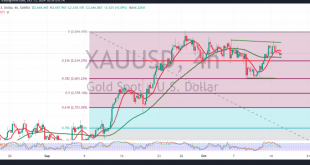

Gold prices surged, reaching the target set in the previous technical report at $2677 per ounce during morning trading. The simple moving averages continue to support the potential for further upward movement, with the 14-day momentum indicator signaling a continuation of the trend as long as prices remain above the …

Read More »Gold remains above support 15/10/2024

Gold prices declined during the morning session, failing to break through the resistance level of 2666 and approaching a retest of 2635. The lowest price recorded so far is $2638 per ounce. Today, we lean toward a positive outlook, primarily relying on the price stability above the key support level …

Read More »Market Drivers; US Session

Dollar Index (DXY) Soars, Dragging Down Major Pairs The US Dollar Index (DXY) continued its upward trajectory, breaching the 103.00 mark, driven by risk-off sentiment in the global market. Key economic indicators and speeches from Federal Reserve officials are scheduled for the day. The Euro (EUR/USD) weakened further, falling below …

Read More »Weekly Wrap: ECB, Earnings Reports in Focus

Global financial markets closed the week ending on Friday, October 11, with risk assets advancing over safe haven assets after US inflation data that highlighted a decline in price growth that would weigh heavily on interest rate cuts in the coming period. Markets are also awaiting developments in monetary policy …

Read More »Gold may continue to achieve bearish targets 9/10/2024

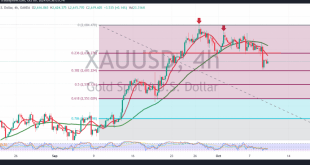

Gold prices saw a sharp decline yesterday, aligning with the negative outlook in the previous report, which anticipated a break of the $2645 support level, reaching the target of $2605 per ounce. Today’s technical view suggests the potential for a continued corrective decline. The 240-minute chart shows a bearish alignment, …

Read More »Weekly Reap: Key Assets Have To Navigate Amid Uncertainties In Q4

Most financial market entered Q4 with a volatile earthquake, largely due to the heightened uncertainty surrounding four key factors: the US labour market, East Coast port strikes, Middle Eastern tensions, and the impending US presidential election. However, the previous trading week brought a glimmer of relief, as the US nonfarm …

Read More »Gold under negative pressure 3/10/2024

Gold prices have been trading in a narrow sideways range, with support holding above the 2645 DGM level and resistance below 2665. The technical outlook for today suggests the possibility of continuing the corrective decline, especially after gold failed to break through the 2665 resistance. A closer look at the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations