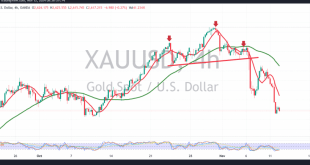

Gold experienced strong selling pressure, maintaining its downward trend and surpassing the target station of 2647, with prices dropping to a low of $2610 per ounce. Technical Analysis: Bearish Outlook: Today’s analysis indicates a continued bearish sentiment, as gold remains below the simple moving averages, which reinforce the likelihood of …

Read More »Gold: Negative pressure persists 11/11/2024

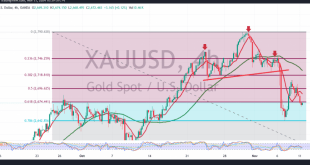

Gold prices remain under continuous bearish pressure, registering a new session low at 2666 per ounce in morning trading. Technical Analysis: Bearish Trend Confirmation: The break below the 2674 level, corresponding to the 61.80% Fibonacci retracement, reinforces the downside momentum. Additionally, the price struggles to overcome the 2700 psychological resistance, …

Read More »Weekly Recap: Elections, Fed to continue as market movers for a while

Last week marked pivotal to financial markets because of the US presidential election results and the Federal Reserve’s interest rate decision. This confluence of events has the potential to significantly shape the trajectory of global asset prices and market trends for years to come. Given the far-reaching political and economic …

Read More »Gold Prices Dip Amid Dollar Rally Post-Trump Election Win; Industrial Metals Show Mixed Trends

Gold prices slipped slightly in Asian trade on Thursday, extending the losses from the previous session, triggered by a sharp rally in the dollar and risk assets following Donald Trump’s victory in the 2024 U.S. presidential election. Despite this recent decline, gold has managed to hold on to significant gains …

Read More »Market Drivers; US Session

The US Dollar Index (DXY) rose to four-month tops north of the 105.00 hurdle on the back of Trump’s win and higher US yields. The Fed’s interest rate decision will be at the centre of the debate, seconded by weekly Initial Jobless Claims and Wholesale Inventories.The US dollar has touched …

Read More »Gold and Industrial Metal Markets React to U.S. Election and Economic Concerns

Gold prices edged lower in Asian trading on Wednesday, influenced by a surge in the U.S. dollar and Treasury yields amid early 2024 U.S. election results favoring Donald Trump. However, with the election results still too close to call, gold held near its recent highs. Precious Metals Spot Gold: Dropped …

Read More »How should investors get prepared for Market Moves, Fluctuations Amid US Election?

Preparing for Market Volatility Ahead of the US Election As the US election approaches, investors are bracing for potential market moves and fluctuations. Preparing for these shifts involves several strategic steps to mitigate risk and capitalize on opportunities.One of the most important strategies is portfolio diversification. By spreading investments across …

Read More »Gold to be monitored closely 31/10/2024

Gold prices have continued their historic climb, reaching $2790 per ounce after surpassing the previous peak of $2758. Technical Analysis: The 4-hour chart shows that simple moving averages continue to support the upward momentum, while the momentum indicator remains strong above the 50 midline, indicating a sustained bullish outlook. For …

Read More »Gold’s Meteoric Rise: A Safe-Haven Surge

Gold, the timeless haven asset, has recently surged to unprecedented heights, reaching a record high of $2,790. This meteoric rise is a testament to its enduring appeal as a safe-haven asset during times of economic uncertainty and geopolitical turmoil. Gold’s recent surge is a testament to its enduring appeal …

Read More »Gold records lower highs 29/10/2024

Gold prices are currently showing positive momentum as they attempt to breach the recent peak of $2758 per ounce. Technical Analysis: Analyzing the 4-hour chart, gold has started forming lower peaks, suggesting a potential continuation of a downward correction. The Stochastic indicator is also providing negative signals, indicating a possibility …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations