Gold prices have surged in recent weeks, fueled by escalating geopolitical tensions and concerns about global economic stability. As the Russia-Ukraine conflict continues to escalate and the Middle East remains a volatile region, investors have sought refuge in gold, driving its price to levels not seen in years. A Perfect …

Read More »Gold Shines Amidst Geopolitical Turmoil, Economic Uncertainty

Gold prices have surged in recent weeks, driven by a confluence of factors including escalating geopolitical tensions, economic uncertainty, and a weakening US dollar. As investors seek safe-haven assets, gold has emerged as a preferred choice, reinforcing its traditional role as a hedge against inflation and market volatility.Geopolitical Tensions Fuel …

Read More »Gold Prices Rally on Weak Dollar and Geopolitical Tensions

Gold prices edged higher in Asian trade on Friday, driven by a weaker dollar and heightened geopolitical tensions, as traders positioned themselves ahead of a potential December interest rate cut by the Federal Reserve. The precious metal, often viewed as a safe haven, regained some of the ground lost earlier …

Read More »Gold Edges Lower Amid Inflation Concerns and Rate Cut Uncertainty

Gold prices faced slight declines during Thursday’s Asian trading session, reflecting market uncertainty over the Federal Reserve’s rate-cut trajectory. The robust U.S. economy and persistently high inflation have tempered expectations for aggressive monetary easing in the near future. Key Factors Driving Gold Prices U.S. Economic Data: The Personal Consumption Expenditures …

Read More »Gold Prices Inch Higher Amid Trump Tariff Threats and Mixed Safe-Haven Signals

Gold prices edged up slightly in Asian trade on Wednesday, continuing modest gains from the previous session as safe-haven demand remained supported by concerns over potential U.S. trade tariffs. However, the metal’s ascent was tempered by a resilient U.S. dollar and easing tensions in the Middle East, which dampened some …

Read More »Gold Prices Edge Higher as Trump’s Tariff Threats Bolster Safe-Haven Demand Amid Mixed Market Dynamics

Gold prices saw a modest uptick during Asian trading on Tuesday, driven by escalating geopolitical and trade concerns, though gains were capped by a stronger U.S. dollar and easing Middle Eastern tensions. Key Market Moves Spot gold increased by 0.1% to $2,628.69 an ounce. Gold futures (December) rose by 0.4% …

Read More »Gold Prices Decline Amid Risk-On Sentiment: A Short-Term Retreat and Medium-Term Outlook

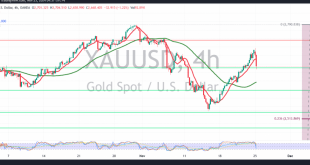

Gold prices faced a sharp drop today, retreating from a three-week high, as a risk-on environment diminished the appeal of the precious metal. The XAU/USD pair struggled to sustain its momentum from last week’s gains, though it managed to hold above the $2,650 level, supported by the 100-period Simple Moving …

Read More »Gold to be monitored 25/11/2024

Gold resumed its bullish momentum during the previous session, surpassing the official target of $2700 per ounce and recording its highest level at $2720. From a technical perspective, the current movement shows a slight bearish tendency due to encountering the pivotal resistance at $2720. However, a closer look at the …

Read More »Gold Prices Poised for Growth in 2025 Amid Economic and Geopolitical Tailwinds

Analysts at UBS forecast sustained upward momentum in gold prices throughout 2025, driven by a combination of declining global interest rates and persistent geopolitical risks. These factors reinforce gold’s status as a reliable safe-haven asset while aligning with favorable macroeconomic trends. Key Drivers for Gold’s Rally Lower Interest Rates Central …

Read More »Gold Poised for Biggest Weekly Gain in Eight Months Amid Escalating Tensions

Gold maintained its upward momentum on Friday, setting the stage for its largest weekly gain in nearly eight months. The precious metal’s appeal as a safe haven surged amid heightened geopolitical tensions, as Russia lowered its nuclear weapon usage threshold and launched a hypersonic missile at Ukraine. Spot gold remained …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations