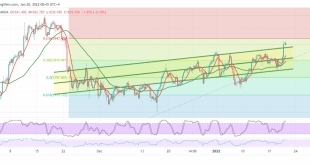

Gold managed to retest the support line of the ascending price channel shown on the chart located at 1825, maintaining the bullish bias and hovering around its highest level during the early trading of the current session 1844. Technically, and carefully looking at the 4-hour chart, we notice the regularity …

Read More »Market Drivers – US Session – 25 January 2022

Traders and market participants await the US Fed to adopt firm plans to raise interest rates and taper its holdings of U.S. Treasury bonds and mortgage-backed securities, which have swollen its balance sheet to about $9 trillion.The Fed’s two-day meeting ends Wednesday. Analysts’ views of the meeting are mixed, with …

Read More »Gold Prices Jump Boosted By T-Yields Drop

A quick drop in US yields boosted XAU/USD that jumped from $1840 to $1853, reaching the highest level since November 19. It then pulled back all the way to $1840 and now is approaching the $1850 area again. Prices remain volatile in metals, stocks and bonds. The spike in gold …

Read More »Gold Is Looking For Additional Momentum 25/1/2022

Gold managed to retest the support line of the ascending price channel shown on the chart located at 1825, maintaining the bullish bias and hovering around its highest level during the early trading of the current session 1844. Technically, and carefully looking at the 4-hour chart, we notice the regularity …

Read More »Gold May Witness a Temporary Bearish Slope 21/1/2022

The yellow metal prices found a strong resistance level at 1847, which we mentioned during the previous analysis that breaching it is a basic and important condition to continue the rise. Technically, the intraday movement of gold is witnessing stability below the mentioned resistance. However, by looking at the 4-hour …

Read More »How Is US Dollar Hit by Employment Data?

The US dollar traded with a soft tone on Thursday, ending the day mixed across the major currencies. The EUR was among the weakest, while the AUD and the CAD were the strongest.Disappointing US employment data was behind the broad dollar’s weakness at the beginning of the American session, as …

Read More »Gold Catches Breath After Rising to The Highest in Two Months

Gold prices held near two-month highs on Thursday as falling US Treasury yields and a weaker dollar spurred investor appetite, fueled by concerns about inflation and political tensions. Gold in spot transactions fell 0.2 percent to $1836.80 an ounce by 1102 GMT, after hitting its highest level since November 22 …

Read More »Gold Reverses The Downtrend 20/1/2022

Gold prices achieved noticeable gains and reversed the bearish trend as we expected, in which we relied on trading stability below the 1820 resistance level, recording the highest level at 1844. Technically, trading above the previously breached resistance-into-support at 1820 price supports the possibility of the upside and price movements …

Read More »Gold Momentum Eases After Prices Ticked $1840

Gold’s upside momentum has waned in recent trade, with prices trading near $1842 after bursting above resistance in the low $1830s and then subsequently $1840 for the first time in over two months. The speed of spot gold’s latest advances, especially between the $1830 to $1840 area, is suggestive of …

Read More »Gold Rises From Its Lowest Level in a Week

Gold prices rose on Wednesday, but moves were limited as markets looked ahead to the upcoming Federal Reserve meeting as it is widely expected to raise interest rates in an attempt to contain rising inflation. Gold in spot transactions rose 0.2 percent to $ 1817.90 an ounce by 1217 GMT, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations