Gold prices declined significantly since the beginning of this week’s trading within the expected bearish path mentioned in the last technical report; trading below the pivotal support floor extends losses to visit 1907, recording its lowest level during the current week of 1891. On the technical side today, and by …

Read More »Gold price slides below $1,900 As USD Strengthens, US GDP Awaited

Gold price was wavering in a minor range of $1,891.56-1,911.31 since Monday after an intense selloff had continued from Friday’s high at $1,955.71. The gold price is now stabilizing currently in a concise range but price action is favoring an extreme imbalance on the downside amid the rising US dollar …

Read More »Gazprom to suspend Russia’s gas supplies through Bulgaria as of Wednesday

Russian state-owned gas supplier Gazprom is to halt supplies going through Bulgaria and Poland into Europe as of Wednesday 27 April, Bloomberg reported on Tuesday, citing the Bulgarian Energy Ministry. This is a remarkable and major escalation in the standoff between Moscow and European nations over energy supplies and the …

Read More »Gold rises supported by concerns about growth and inflation

Gold prices rose on Tuesday as investors sought safe assets amid concerns about global growth and rising inflation, but bets on sharp US interest rate hikes kept the yellow metal close to its four-week low hit in the previous session. Spot gold rose 0.3 percent to $1,903.70 an ounce by …

Read More »Gold price succumbs to weakening yuan

Gold Price remains on slippery slopes. Coronavirus-related lockdowns in China are set to continue weighing on the yellow metal, economists at TD Securities report.“Gold prices are succumbing to a weakening yuan as China’s worsening COVID-19 outbreak saps the buying impulse from yet another pillar of demand for bullion.” “With little …

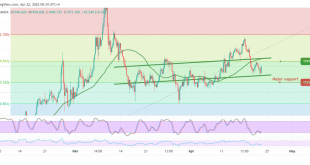

Read More »Gold touches goal, hovers around the support 25/4/2022

We remained on the fence during the previous analysis, explaining that we are waiting for the pending orders to be activated. We explained that trading below 1940 increases the strength of the bearish trend, targeting 1925 , gold recorded a low at 1925. On the technical side today, and by …

Read More »Gold is looking for a catalyst 22/4/2022

Limited positive attempts were witnessed by gold’s movements yesterday, unable to breach the pivotal resistance level at 1959, which forced the price to touch the 1936 level. Technically, gold prices got additional support due to the intraday stability above the 1940 support floor. However, with a careful look 240-min chart, …

Read More »Gold Trying to Rise 21/4/2022

Gold prices repeated their attempts to rise again, benefiting from stability above the 1940 support level, rebounding to the upside to retest the previously broken support level that turned into the 1959 resistance level. On the technical side, the 50-day simple moving average is still trying to pressure the price …

Read More »Gold firming at daily support

The Gold Price fall was capped by falling US Treasury yields amidst a risk-on market mood. US Treasury yields dropped from three-year highs and undermined the US dollar. Bulls start to engage at the start of a demand area, eyes on daily M-formation.Gold Price is higher in the US session, …

Read More »Gold at its lowest level in two weeks, affected by US bond yields and the dollar

On Wednesday, gold prices fell to their lowest in nearly two weeks, weighed down by persistently higher US bond yields and the dollar. By 0741 GMT, spot gold fell 0.4 percent to $ 1941.40 an ounce, and US gold futures fell 0.7 percent to $ 1944.80. On Tuesday, the price …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations