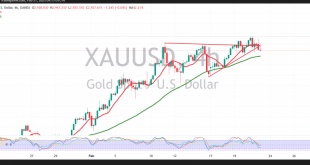

Gold Hits Record Highs Before Facing Profit-Taking Pressure Gold prices extended their rally in the previous trading session, surpassing the key $2,950 per ounce target and reaching a new high of $2,954. Technical Analysis Despite the strong long-term bullish trend, intraday movements indicate a bearish pullback due to profit-taking and …

Read More »Gold tries to regain the upward path 18/2/2025

Gold (XAU/USD) Technical Analysis Gold prices began today’s trading with an upward trend after last Friday’s decline and profit-taking pushed prices down to $2878 per ounce. Technical Outlook: Bullish Signals: The price remains stable above the 50-day simple moving average (SMA). Intraday support is confirmed at 2887, with a broader …

Read More »Weekly market wrap: Dollar and gold drivers

US Dollar turned lower last week after the strong bad effect of Trump’s trade rhetoric faded to some extent. The currency also missed the opportunity to make use of the testimony of Fed’s chief Jerome Powell against the Senate. Recent inflation and spending data played a role in dollar weakness …

Read More »Gold rests on support 13/2/2025

Gold Price Analysis Gold successfully retested the 2870 support level and closed above it, initiating an upward move in today’s session, reaching $2918 per ounce. Technical Outlook: Bullish Indicators: Simple moving averages support the continuation of the upward trend. The 14-day momentum indicator signals positive momentum. Bearish Risk: A drop …

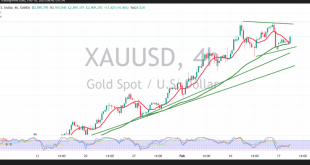

Read More »Gold hits record highs 11/2/2025

Gold continues to post record highs, extending its longest winning streak since 2020, reaching $2942 per ounce during early trading today. Technical Outlook: The 4-hour chart shows that simple moving averages continue to support an upward trajectory. However, gold is facing resistance at $2942, aligning with the upper boundary of …

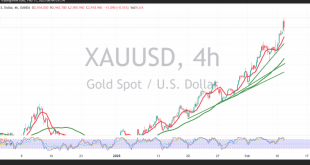

Read More »Gold may continue to rise 6/2/2025

Gold prices successfully reached the target of 2870 in the previous session, recording a new high at $2882 per ounce. Technical Outlook: Moving averages continue to support an upward trend. Gold remains within an ascending price channel, with 2840 acting as a key support level. Key Levels to Watch: Bullish …

Read More »Gold Prices Steady as Markets Weigh Fed’s Hawkish Stance, Trade War Risks

Gold prices held steady in Asian trading on Thursday, as investors evaluated the Federal Reserve’s firm stance on interest rates alongside rising uncertainty over U.S. tariffs. Spot gold (XAU/USD) edged 0.1% higher to $2,765.64 per ounce. Gold futures (February contract) climbed 0.3% to $2,803.39 per ounce by 01:45 ET (06:45 …

Read More »Gold is based on support 30/1/2025

Gold managed to establish strong support above $2740, rebounding higher in the previous session and reaching $2766 per ounce. Technical Outlook: The price remains above the 50-day simple moving average, reinforcing bullish momentum. The Stochastic indicator shows positive signals, suggesting further upside potential. Key Levels to Watch: Above $2770: A …

Read More »Gold Holds Steady as Markets Await Fed Decision and Trump’s Trade Moves

Gold prices remained largely unchanged in Asian trading on Wednesday as investors braced for the Federal Reserve’s policy decision amid growing uncertainty surrounding U.S. trade policies under President Donald Trump. Spot gold was muted at $2,762.64 per ounce, while gold futures for February delivery edged up 0.1% to $2,796.06 an …

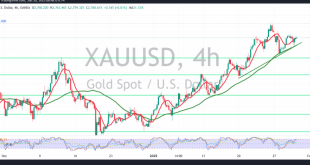

Read More »Gold continues its rise, Eyes on the Fed 29/1/2025

In the previous report, we maintained a neutral stance due to conflicting technical signals, noting that a confirmed breach of the 2755 resistance level could lead to a new upward wave, targeting 2765, with the price reaching a high of $2766 per ounce. From a technical perspective today, the 4-hour …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations