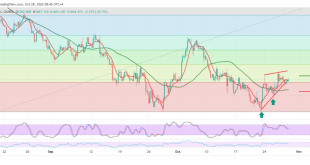

Narrow sideways trading tended to the negativity that dominated gold’s movements during the previous session, under pressure from the rise of the US dollar, reaching the lowest of 1654, after it failed to cross upwards to the resistance level of 1670. Technically, the 50-day simple moving average is trying to …

Read More »Market Drivers – US Session 27/10/2022

The American dollar restores its previous weak tone, as US Treasury yields edged sharply lower following the release of the preliminary estimate of the Q3 Gross Domestic Product. Important events are streaming on the macroeconomic calendar having less impact than anticipated, despite bringing about some new developments. Wall Street got …

Read More »Gold Under Pressure On US Dollar’s Correction

Gold prices are under pressure. The precious metal is actually forced back into the neutral zone on the daily chart. The hourly charts show that the price is balanced at a critical stage. Investors are eying Friday’s PCE and next week’s Fed. The price of gold has been pressured on …

Read More »Gold needs extra momentum to continue rising 27/10/2022

We remained neutral during the previous session’s trading, explaining that we are waiting for the activation of the pending orders due to the conflicting technical signals at the time of the report’s release, explaining that activating the buying positions depends on confirming the breach of 1666 to target 1677, recording …

Read More »Gold recovers as dollar falls on bets on a slower rate of hike

Gold rose on Wednesday as the dollar and US Treasury yields fell amid expectations that the Federal Reserve may slow the pace of interest rate hikes. And gold rose in spot transactions 0.7 percent, recording 1663.26 dollars an ounce by 0644 GMT. US gold futures rose 0.6 percent to $1,667.10 …

Read More »Gold is waiting for a new signal 26/10/2022

Gold attempts continue to rise, but still limited attempts are ineffective after a strong confrontation with the pivotal resistance level published during the previous analysis at1660 price, which still constitutes an obstacle to the price until now, unable to break it. On the technical side, and by looking at the …

Read More »Gold benefits from declining US bond yields

Gold price advances early in the New York session, up by 0.33% on falling US Treasury yields, while bonds climb amid further expectations that Fed could slow the pace of its rate hikes and monetary tightening measures. The US dollar weakened, constituting a chance of momentum for the precious metal. …

Read More »Gold prices decline with the stability of the dollar

Gold prices fell on Tuesday as the dollar stabilized, but expectations that the Federal Reserve would slow the pace of interest rate hikes limited the precious metal’s losses. Spot gold fell 0.5% to $1,640.62 an ounce by 1238 GMT, while US gold futures fell 0.6 percent to $1,644.70. The dollar …

Read More »Market Drivers – US Session 24/10/2022

The US dollar began the trading week with negative performance, extending its Friday’s decline at the opening, but the dollar gradually edged higher as the day went by. The American currency closed with modest gains against most major rivals while traders and investors are eying significant events scheduled later in …

Read More »Gold futures lower after Friday’s wild surge

Gold prices finished Monday with a shy loss, following a wild soaring in the final session of last week that saw prices for the precious metal briefly dip to fresh lows. Gold was not stable to begin the week, as the bears have been able to pull the rope to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations