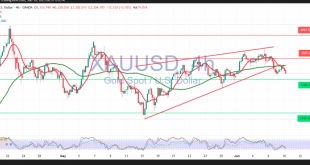

Gold prices experienced mixed performance during the previous trading session, with bullish momentum fading and the market opening today with a bearish bias. From a technical standpoint, a closer analysis of the 4-hour chart shows that gold failed to break through the critical resistance level at $3,325. The simple moving …

Read More »Gold Prices Steady as Risk Appetite Grows; Platinum Hits Four-Year High Ahead of U.S.-China Trade Talks

Gold prices showed little movement on Monday during Asian trading, maintaining strong gains from the previous week. The market’s focus was squarely on high-level U.S.-China trade talks scheduled for later in the day, which fueled optimism for a potential de-escalation in the trade conflict between the two largest economies in …

Read More »Gold Prices Steady as Traders Weigh Trump-Xi Trade Talks and Geopolitical Tensions

Gold prices traded in a narrow range during Asian hours on Wednesday, as investors balanced a modest return in risk appetite against persistent safe haven demand. Speculation over a possible meeting between U.S. President Donald Trump and China’s President Xi Jinping helped buoy market sentiment, but gold remained well-supported amid …

Read More »Gold Edges Lower Amid Profit-Taking, But Geopolitical Tensions and Trade Uncertainty Keep Prices Elevated

Gold prices slipped in Asian trade on Tuesday as traders booked profits after a strong rally fueled by renewed geopolitical risks and persistent trade tensions. The yellow metal had surged over 2% on Monday, buoyed by heightened uncertainty surrounding the Russia-Ukraine war, U.S.-Iran nuclear talks, and ongoing concerns about U.S. …

Read More »Gold May Retest Support Levels 3/6/2025

Gold prices saw large, broad movements during the previous trading session, fueled by strong upward momentum that pushed the price to a high of $3,392 per ounce. From a technical perspective, the 4-hour chart shows that the simple moving averages continue to support the daily uptrend. However, negative signals are …

Read More »Gold Rises as Trade Tensions, Dollar Weakness Support Safe-Haven Demand

Gold prices gained in Asian trading on Monday, as heightened tensions between the U.S. and China and uncertainty surrounding President Donald Trump’s tariff agenda fueled demand for safe-haven assets. Broader metal markets also found support from a softer dollar, after a Federal Reserve official hinted at the possibility of interest …

Read More »Gold Slips as Dollar Strength, Profit-Taking Weigh; Traders Eye U.S. Inflation Data

Gold prices declined in Asian trading on Friday, pressured by a stronger U.S. dollar and profit-taking, as traders braced for fresh inflation data that could shape the Federal Reserve’s interest rate outlook. Spot gold fell 0.7% to $3,293.44 an ounce, while gold futures for August delivery slipped 0.8% to $3,316.67/oz …

Read More »Gold Prices Fall as Trump Tariff Ruling Sparks Risk Rally and Dollar Strength

Gold prices extended their recent decline in Asian trading on Thursday, as a U.S. federal court ruling against President Donald Trump’s proposed trade tariffs bolstered risk sentiment across markets. The ruling also fueled a stronger U.S. dollar, further weighing on gold and broader metal prices. Spot gold fell 0.5% to …

Read More »Gold starts negatively 29/5/2025

Gold prices achieved the first upside target at $3,311 at the start of the European trading session, reaching a high of $3,325, though gains remained modest. As highlighted in the previous report, price consolidation at $3,270 was expected to halt the bullish momentum and apply negative pressure, potentially triggering a …

Read More »Gold Prices Slip as Risk Appetite Improves, Dollar Recovers

Gold prices edged lower in Asian trading on Wednesday, weighed down by a revival in risk appetite after U.S. President Donald Trump delayed plans to impose steep tariffs on the European Union. The move, which helped lift equity markets and investor sentiment, reduced demand for safe-haven assets like gold. Spot …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations