Gold prices posted a strong advance during today’s morning session, supported by the formation of a solid support base near $3,310—in line with the anticipated bullish scenario. The metal reached the initial upside target at $3,320, with a session high of $3,340 at the time of writing. Technical Outlook – …

Read More »Gold Slips Toward Support: Rebound or Breakdown Ahead? 9/7/2025

Gold prices failed to maintain their upward momentum and began today’s session under renewed selling pressure, breaching the key support level at $3295 — a level we previously identified as a critical threshold for sustaining the bullish outlook. In early trading, gold dipped to a low of $3284 at the …

Read More »Will Gold Rally After Establishing Support? 8/7/2025

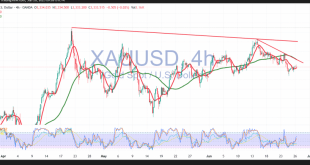

Gold prices recorded a strong session of positive movement, rebounding sharply after finding firm support at the key $3295 level. The recovery led to an intraday high of $3345 per ounce, highlighting a technical bounce from oversold territory. Technical Outlook – 4-Hour TimeframeThe $3345 zone is currently acting as a …

Read More »Strong Buying Momentum Puts Gold Back in the Spotlight 2/7/2025

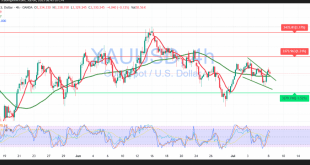

Gold prices saw a strong rebound in the previous session, achieving a short-term upward correction within a broader downtrend, reaching the anticipated technical targets of $3327 and $3360, with a session high at $3358 per ounce. Technical Outlook (4-hour chart):The $3358 resistance level has proven to be a firm barrier, …

Read More »Controlled Rebound: Gold Rises Amid a Bearish Backdrop 26/6/2025

Gold prices showed limited movement during the previous trading session but opened the early hours with a cautious rise after approaching oversold levels, recording a high of $3,343. From a technical standpoint, gold appears to be attempting to recover some of its earlier losses. Intraday charts suggest a modest upward …

Read More »Gold Lacks Conviction Amid Uncertain Direction 25/6/2025

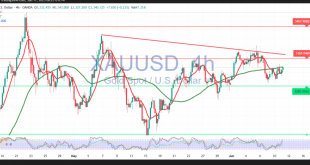

Gold prices took a sharp downturn during the previous session, hitting a low of $3,295 per ounce. From a technical standpoint, the market is attempting a modest rebound following oversold conditions. However, the 60-minute chart shows the price is still contained within a downward corrective wave, bounded by a descending …

Read More »Gold Tries to Restore Upward Momentum 17/6/2025

Gold experienced a downward trend during yesterday’s session, moving within a weak and somewhat indecisive pattern that deviated from the anticipated bullish outlook. Despite this, the price remained above the key support level of $3,390, recording a session low at $3,373 per ounce. From a technical standpoint, today’s outlook remains …

Read More »Gold Undergoes Overbought Correction 16/6/2025

Gold prices surged significantly, propelled by intensifying geopolitical tensions, surpassing the official target of $3,416 mentioned in the previous technical report and reaching a new all-time high of $3,451 per ounce. Technically, while the Relative Strength Index (RSI) indicates overbought conditions, which could suggest a temporary slowdown, the broader trend …

Read More »Gold Attempts to Regain Its Uptrend 12/6/2025

Gold prices exhibited mixed behavior during recent sessions, initially continuing the expected corrective decline and approaching the first downside target of $3,312, as highlighted in the previous technical report. The metal recorded a low of $3,315 before reversing course, driven by a sharp rebound following the release of U.S. inflation …

Read More »Gold Seeks a Stronger Direction 11/6/2025

Gold prices showed mixed performance during the previous session, largely aligning with the anticipated downward corrective trend outlined in the prior technical report. The bearish scenario was initially supported by trading remaining below the $3,325 resistance level. However, as cautioned, any attempt to break above $3,325–$3,331 would invalidate that outlook. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations