GBP/USD tried but was unable to break above its 1.3500-1.3650ish range that has prevailed for most of February. The pair fell back under 1.3600 in the US session as geopolitical angst remains elevated. That kept USD in demand and negated pushback against a 50bps March rate hike from Fed’s Williams.The …

Read More »How Will Canada’s Jobs Data Influence The Loonie?

The latest batch of Canadian employment data will hit the markets on Friday. So far, it looks that the Omicron wave hit the labour market in January, with forecasts pointing to a drop of jobs. This is probably a temporary setback. The loonie has been driven mostly by risk sentiment …

Read More »Oil is on Track For a Sixth Week of Gains Amid Supply Concerns

Oil prices rose on Friday, set for a sixth straight week of gains as geopolitical tensions continued to fuel supply concerns. Brent crude futures rose 63 cents, or 0.7 percent, to $89.97 a barrel by 1013 GMT, after reaching $91.04 on Thursday, the highest level since October 2014. West Texas …

Read More »Market Drivers – US Session – 27 January 2022

Although traders are still digesting Fed’s policy statement, Thursday’s US session closed on a positive note for both US stocks and the US dollar, seen rising at the same time.The interest rate policy statement and the remarks by Fed Chairman, Jerome Powell, were among the most important factors that continued …

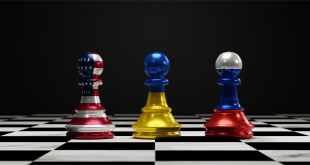

Read More »How Latest Geopolitical Tensions Impacted Financial Markets

Tensions are escalating in Eastern Europe as several reports refer to potential invasion of Ukraine. The crisis brought about several important developments that, in effect, throw heavy shadows on the financial markets, and, in turn, impact price movements as well as igniting concerns on oil supply disruption.The new developments include …

Read More »Oil Hits Seven-Year High on Ukraine Tensions

Oil traded at a seven-year high of around $90 a barrel on Thursday as the Ukraine crisis supported prices despite signs that the US Federal Reserve would tighten monetary policy. Brent crude futures rose six cents, or 0.1 percent, to $90.02 a barrel by 1113 GMT, and West Texas Intermediate …

Read More »KSA Expected To Hike Oil Price On Robust Demand

Saudi Arabia is expected to raise the official selling prices of all its crude grades sold in Asia next month on the back of solid demand and refining margins.Saudi Arabia usually sets the official selling prices (OSPs) of its crude for the following month around the fifth of each month, …

Read More »Oil Price Peaks Up To $90 Level For First Time Since 2014

Brent crude futures rose more than 2% on Wednesday, surpassing $90 a barrel for the first time since 2014. The price of oil surpassed $90 a barrel on Wednesday, its highest mark in eight years as limited supply coupled with the prospect of a Russian invasion of Ukraine sent energy …

Read More »Major Currencies Trade With Pro-Risk Bias

Uneven and rather unpredictable trading conditions have prevailed for a second successive session on Tuesday. Ahead of the US close, the S&P 500 is still trading in the red territory but has recovered sharply off earlier session lows, giving a sense of De-Ja Vu after yesterday’s ferocious late-session recovery.The net …

Read More »USD/CAD Rallies Amid Broad Risk Asset Retreat

Having started the day closer to 1.2550, and being on course to post on-the-day gains of about 1.0%, the USD/CAD pair is currently penetrating the 1.2700 level having rallied from the mid-1.2500s on Monday amid widespread losses for risk assets m meanwhile, safe-haven demand amid geopolitical tensions and amid pre-Fed …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations