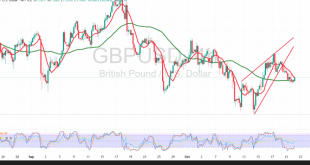

GBP/USD has been range-to-lower, fulfilling the 1.3360 target within the anticipated bearish trajectory. Technical:RSI continues to emit short-term negative signals. Intraday price action remains below the 1.3400 psychological barrier, keeping topside attempts constrained and preserving downside pressure. Base case (downside continuation):Bias stays lower while below 1.3400. A decisive break below …

Read More »Freefall in Gold — Is This the Start of a Major Correction? 22/10/2025

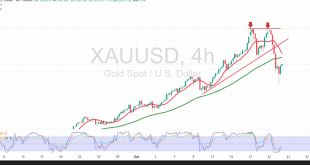

Gold (XAU/USD) sold off sharply after failing to reclaim the $4,380 pivot, in line with the prior bearish bias. The drop forced a retest of $4,245 and extended to a $4,005 low before stabilizing. Technical:A clear double-top has formed, reinforcing short-term seller control. Price holds below down-sloping SMAs, which are …

Read More »CAD Challenges Key Resistance 21/10/2025

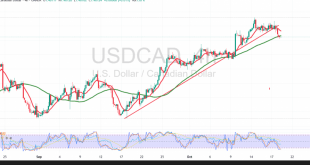

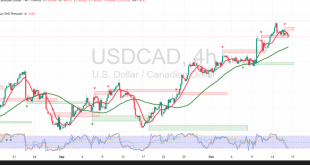

USD/CAD stays bid, pressing the 1.4050 barrier as buyers attempt a topside break following a constructive start to the session. Technical:RSI has turned higher, flagging improving momentum. Price holds above the 50-period SMA, which is lending dynamic support and aligning with attempts to clear 1.4050. The 1.4000 zone remains the …

Read More »Pound Begins Pressuring Support 21/10/2025

GBP/USD remains under bearish control after slipping through the 1.3400 pivot, trading near 1.3387 at the time of writing as sellers press the downside. Technical:The RSI has turned lower, confirming firm negative momentum on the 4-hour chart. Intraday stability below 1.3400 keeps the pressure skewed to the downside and limits …

Read More »Gold Poised Between Rock-Solid Support and Pivotal Resistance 21/10/2025

In the prior note we flagged indecision and said an hourly close above 4,280 would confirm bullish continuation toward 4,350. Since then, gold has held above 4,245, turning that area into a key support while price compresses beneath nearby resistance. Technical (4H):Price action is clearly above 4,245, reinforcing role-reversal support …

Read More »CAD Breaches Rising Trendline Support 20/10/2025

USD/CAD has flipped softer after several sessions of gains, with sellers probing for control in the near term. Technical:RSI has turned lower, signaling fading upside momentum. Price has also broken an ascending trend line, adding to negative pressure. Below, 1.4050 is acting as near-term resistance that caps rebounds. Base case:While …

Read More »Pound Retests Resistance 20/10/2025

GBP/USD has turned positive intraday after a brief hold above 1.3400 (psychological support), but the recovery looks fragile into nearby resistance. Technical:RSI is hovering near overbought, hinting at fading momentum. The 50-period SMA sits near 1.3450, acting as overhead resistance and reinforcing a cautious tone on the 4-hour chart. Base …

Read More »Gold Between Firm Support and Pivotal Resistance — Break or Bounce 20/10/2025

Gold (XAU/USD) swung sharply on Friday, spiking to $4,380 before retreating to a $4,185 low into the close. The tape remains choppy but underpinned by safe-haven demand. Technical (4H):Price is holding above $4,200, which has flipped into key support and provides a firm floor against deeper pullbacks. Up-sloping SMAs confirm …

Read More »CAD Seeks Support 16/10/2025

USD/CAD is correcting lower in a bearish sub-trend within the broader uptrend, as markets consolidate recent gains ahead of policy headlines. Technical:RSI is attempting to exit oversold, hinting at base-building for a rebound. Price continues to hold above the 50-period SMA, keeping the larger bullish structure intact. The 1.4000 zone …

Read More »Pound Breaks Above Uptrend Line 16/10/2025

GBP/USD has shifted back to positive price action after concluding the prior downswing, with buyers reasserting control in the near term. Technical:Momentum is improving as the RSI turns higher, signaling additional upside impulse. On the 4-hour chart, price is trading above the 50-period SMA, which has flipped to dynamic support …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations