Gold prices (XAU/USD) saw an upward rebound yesterday, benefiting from touching the 3310 support level to reverse the expected downward trend from the previous report. That report was based on the price remaining stable below the 3340 resistance level, noting that a break of 3340 might open the way for …

Read More »Canadian Dollar: Between Correction and Uptrend 20/08/2025

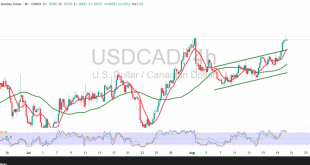

The USD/CAD pair has been dominated by an upward trend after recording repeated closes above the pivotal support level of 1.3800, which reinforces the pair’s positive outlook. Technical Outlook – 4-Hour Timeframe The pair is currently facing a strong resistance level around 1.3880. The Relative Strength Index (RSI) is clearly …

Read More »Pound Sterling Faces Strong Pressure from the USD 20/08/2025

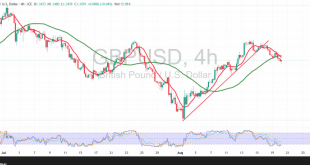

The GBP/USD pair recorded significant declines during the previous trading session, hitting its lowest level at 1.3462. Technical Outlook – 4-Hour Timeframe The pair’s stability below the Simple Moving Average (SMA), which coincides with the previously broken support area now acting as a resistance level at 1.3510, reinforces this level’s …

Read More »Weak Upward Momentum Leaves Gold Under Sellers’ Control 20/08/2025

Gold prices (XAU/USD) saw a sharp decline during the previous trading session, continuing the movement anticipated in our last technical report. Prices have already touched the target level of $3310.Technical Outlook – 4-Hour Timeframe Gold prices are trading below the major support level around 3325, which was broken during the …

Read More »Weekly Market Recap: A Whirlwind of Data, Geopolitics

A complex interplay of economic data, geopolitical developments, and central bank pronouncements prevailed, resulting in shifts across various asset classes. From fluctuating Treasury yields and evolving sector leadership to the resurgence of European equities, the steady ascend of gold prices, and fresh sanctions impacting commodities, investors navigated a landscape rife …

Read More »Pound Strengthens Against Dollar Amid Weak US Data

The British Pound has rallied against the US Dollar, surpassing the 1.2600 mark. This surge is primarily attributed to unexpectedly weak US retail sales data, which suggests a pullback in consumer spending. The Pound’s upward momentum has also been bolstered by positive UK economic indicators. US Retail Sales DisappointUS retail …

Read More »The Fed’s Cautious Path: What to Expect from December’s FOMC Minutes

The Federal Reserve’s decision to cut interest rates in December, while welcomed by some, was marked by a notable degree of caution. The minutes of the December 17-18 policy meeting, to be released on Wednesday, will offer crucial insights into the internal deliberations that shaped this decision.The 25-basis-point rate cut …

Read More »U.S. Futures Edge Higher Amid Softer Inflation Data

U.S. stock index futures advanced slightly on Monday as Wall Street reacted to signs of easing inflation, kicking off a shortened trading week ahead of the Christmas holiday. Dow Jones Futures: +5 points (+0.1%) S&P 500 Futures: +10 points (+0.2%) Nasdaq 100 Futures: +60 points (+0.3%) Markets will close early …

Read More »FOMC Minutes Reflect Fed’s Cautious Stance:

The Federal Reserve’s latest policy meeting minutes reveal a cautious approach to further interest rate cuts, reflecting a delicate balancing act between stimulating economic growth and taming inflation. Divided Fed While the Fed acknowledges that inflation is easing and the labour market remains strong, there is a growing divergence of …

Read More »Investors Await FOMC Minutes, Core PCE

The Dollar Index (DXY) briefly traded above 108 on Friday, driven primarily by euro weakness rather than dollar strength. As we head into a short week due to the US Thanksgiving holiday, market participants are focused on key data releases, including the Federal Reserve’s November FOMC minutes and the core …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations