Oil, Crude, trading

Read More »Market Drivers – European Session 16-11-2021

The European session did not see strong moves and the markets were waiting for the retail sales from the US as well which came in better than expected. The Eurozone economy grew 2.2% on quarter in the three months to September of 2021, beating 2.0% expected and 2.2% previous, the …

Read More »European Shares Hit an All-Time High on Business Results

Several European indices hit record highs on Tuesday, buoyed by signs of easing tensions between the United States and China, solid business results, and dovish comments from the European Central Bank chief. The pan-European Stoxx 600 index rose 0.1 percent by 0829 GMT, adding to the recent record gains, as …

Read More »GBP/JPY: Touches The First Target

The British pound managed to touch the retest target published during the previous analysis, at 153.50, recording its highest level during the early trading of the current session, 153.48. Technically, the pair’s success in building a support floor of 152.80 and the price stability above the 50-day moving average increases …

Read More »British Pound Unchanged

Oil, Crude, trading

Read More »European Shares Fall on Fears of Closing And Mining Stocks Decline

European shares got off to a lukewarm start to the week as investors worried they might resort to shutdowns again to contain COVID-19, with miners the biggest losers in the wake of the metals price crash after China promised to phase out coal at the COP26 climate summit. The Stoxx …

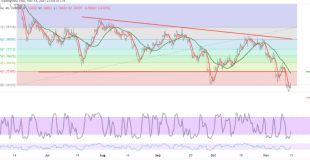

Read More »GBP/JPY: Retest Resistance

After several consecutive sessions of the sideways trend tilted to the downside, GBP/JPY managed to touch the first awaited target at 152.50, recording its lowest level at 152.38. On the technical side, the 50-day moving average still supports the possibility of a decline, in addition to stabilizing trading below the …

Read More »The Pound is Trying to Rise

Oil, Crude, trading

Read More »GBP/JPY: With Little Change

GBP/JPY did not show any change for the third consecutive session within a sideways range sloping to the downside, between the support level of 152.60 the resistance level of 153.60. Technically, we are inclined in our trading to the negativity, relying on the negative pressure coming from the 50-day moving …

Read More »GBP Continues to Decline Against USD

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations