In the past two weeks, central bankers in central Europe have stepped up their hawkish policy messaging in an effort to dissuade investors from placing bets that they will soon start an easing cycle. Their message is beginning to find momentum. These policy cautions came amid a European market slump …

Read More »Japan’s Nikkei records slight gains amid the weakness of the yen

Japan’s Nikkei rose on Friday, trimming its weekly losses, as sentiment was boosted by a weaker yen and Wall Street closing higher overnight. The Nikkei index ended Friday’s trading, up 0.17 percent, at 27,518.31 points. However, it remained far from the high it recorded early in the session at 27,591.15 …

Read More »Japan’s Nikkei index closed at its lowest level in two weeks

Japan’s Nikkei index closed at a two-week low on Thursday, driven by selling in exporters’ stocks after the yen rose overnight, while heavyweight technology stocks followed the Nasdaq’s decline. The Nikkei index fell 1.22 percent to close at 27,472.63 points, the lowest level since March 24. The broader Topix index …

Read More »Euro may show some temporary bearish bias 6/4/2023

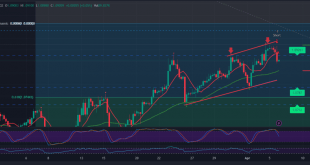

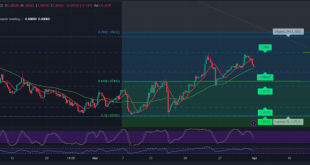

Quiet trading dominated the movements of the EUR/USD pair. No significant change appeared within a limited bearish bias due to the negative pressure after touching the resistance level of 1.0965, to witness the current movements stabilizing above the psychological barrier of 1.0900. On the technical side today, negative signs started …

Read More »European stocks decline after data on the slowdown in economic recovery

European stocks fell on Wednesday as investors became cautious after data indicated a slower-than-expected recovery for the euro-zone economy. The European Stoxx 600 index fell 0.2 percent, with the industrial goods and services sector index declining 1.6 percent, while the utilities sector index rose 1.4 percent. Despite an optimistic start …

Read More »Japan’s Nikkei declined as the yen rose and worries about a US recession

Japan’s Nikkei fell on Wednesday, its first loss in four days, as auto and energy stocks took a hit from a rising yen and fears of a US recession. The Nikkei index extended its losses in the afternoon session, to close down 1.68 percent at 27,813.26 points, dropping below 28,000 …

Read More »Euro continues advancing towards bullish targets 5/4/2023

The Euro-dollar pair was able to trade positively during the previous trading session within the expected positive outlook during the last technical report, touching the first target to be achieved at 1.0965, recording its highest level at 1.0973. Technically, and by looking at the chart, the simple moving averages continue …

Read More »Market Drivers – US Session 04/04/2023 While gold has jumped, US treasury yields retreated, the US dollar was seen under pressure on Tuesday. The dollar is still under pressure ahead of more employment statistics, notably the NFP on Friday, as a result of weak US economic data. On Wednesday, the …

Read More »Euro settled above support 4/4/2023

The Euro tried to maintain the main bullish trend during the first trading of this week, explaining during the previous report that the price remaining above 1.0800 stimulates the price to retest 1.0920, recording its highest level at 1.0925. Technically, the Euro has stabilised above the 50-day simple moving average, …

Read More »Euro is looking for additional momentum 3/4/2023

The single European currency showed movements within a bearish bias due to the clash with the resistance level of 1.0920, which forced the pair to retest 1.0820, which concluded last week’s trading above the mentioned support level. Technically, and looking at the 4-hour chart, we find that the 50-day SMA …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations