European stock markets were calm on Tuesday as telecoms stocks fell, while Swiss stocks outperformed their regional peers after the earnings forecast for pharmaceutical company Novartis was raised. The European Stoxx 600 index settled at 457.71 points by 0711 GMT. The index took a hit on Monday after shares of …

Read More »Euro beats USD 18/7/2023

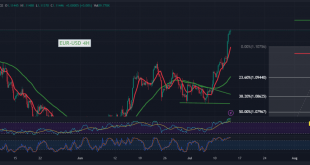

The euro-dollar pair continues to achieve gains within the gradual rise, as we expected, and currently hovering near its highest level during the morning trading of today’s session, at 1.1255. On the technical side, the pair was able to build on the support of the psychological barrier 1.1200, accompanied by …

Read More »European stocks fall after Underwhelming Chinese growth data

After the announcement of dismal Chinese GDP figures, European stock markets declined on Monday as the second quarter results season got underway. At 07:30 GMT, the FTSE 100 in the United Kingdom traded down 0.1%, the CAC 40 in France dropped 0.7%, and the DAX index in Germany traded down …

Read More »European stocks open lower, but are heading for their best weekly performance in more than 3 months

European stocks fell on Friday but remain on course for their biggest weekly percentage jump in more than three months, driven by hopes the Federal Reserve will stop raising interest rates soon as inflation subsides. The pan-European Stoxx 600 index was down 0.2 percent by 0702 GMT. However, it rose …

Read More »Euro achieves bullish targets and continues to advance against USD 14/7/2023

As we expected, the single European currency continued its positive performance against the US dollar, touching the official target station located at 1.1245, recording its highest level at 1.1245 during the early trading of the current session. On the technical side today, by looking at the 4-hour chart, we find …

Read More »European stocks rise, but mixed data limit gains

European stocks rose Thursday, July 13, as US inflation data boosted hopes that the US Federal Reserve is about to end the monetary tightening cycle after the Corona virus pandemic, although a mixed set of economic data limited the increase in gains. The pan-European Stoxx 600 index rose 0.1% by …

Read More »Euro is aggressively attacking USD 13/7/2023

Remarkably positive trades dominated the movements of the euro-dollar pair within the positive technical outlook, as we expected during the previous report, touching the required targets at 1.1100, close by a few pips to the main target 1.1160, recording its highest level at 1.1148. Technically, and with a closer look …

Read More »European stocks rise ahead of the release of US inflation data

European stocks rose on Wednesday ahead of the release of US inflation data that will determine whether the Federal Reserve is close to ending its monetary tightening cycle. The pan-European Stoxx 600 index rose 0.3 percent in early trade. US data, due at 1230 GMT, is expected to show the …

Read More »Euro continues to rally against USD 12/7/2023

The euro traded positively against the US dollar during the previous trading session after it confirmed the breach of the 1.0940 resistance level to start attacking the psychological barrier of 1.1000, recording its highest level at 1.1033. On the technical side today, and by looking closely at the 240-minute chart, …

Read More »European stocks fell after Chinese data raised fears of deflation

European stocks fell on Monday, after recording big weekly losses, as below-expected inflation data in China stoked fears of weak demand, while investors awaited US inflation data as well as corporate earnings due later this week. The pan-European STOXX 600 index fell 0.3 percent in early trading, with China-linked miners …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations