Eurozone business activity showed signs of modest recovery in March, expanding at its fastest pace in seven months, according to the latest HCOB Composite PMI data. The gradual improvement was driven by an easing in the long-running manufacturing downturn, though slower growth in the services sector acted as a drag …

Read More »Euro is facing strong resistance 19/3/2025

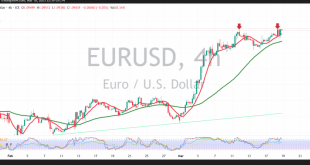

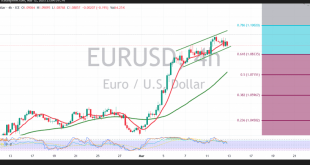

The euro continues to exhibit positive stability against the US dollar, aligning with the expected outlook after reaching the official target level of 1.0945 in the latest technical report, recording a high of 1.0954. From a technical perspective, the 4-hour chart indicates that the euro is encountering key resistance between …

Read More »Euro continues its gradual rise 13/3/2025

The EUR/USD pair successfully reached the first target outlined in the previous technical report at 1.0940, recording a high of 1.0945. Technical Analysis Looking at the 4-hour chart, the pair has established strong support at 1.0830, corresponding to the 61.80% Fibonacci retracement level. Additionally, the Stochastic indicator continues to gain …

Read More »European Stocks Rise as EU Announces Retaliatory Tariffs on U.S. Imports

European stock markets opened higher on Wednesday as investors reacted to the European Union’s decision to impose retaliatory tariffs on U.S. imports worth up to €26 billion. Market sentiment was also boosted by the U.S. decision to resume intelligence sharing and military aid to Ukraine after Kyiv expressed support for …

Read More »European Stocks Steady Amid Tariff Concerns and Coalition Uncertainty; Volkswagen Guidance in Focus

European stock markets ended Tuesday on a broadly steady note, largely recovering from Monday’s sell-off that had been driven by fears over the potential impact of U.S. President Donald Trump’s tariff plans on the U.S. economy. The pan-European Stoxx 600 remained mostly unchanged after hitting its lowest level in nearly …

Read More »Euro tries to build on support 11/3/2025

In the previous trading session, the euro traded in a narrow range as it worked to sustain its upward trend. On the 4‑hour chart, the pair remains supported above its 50‑day simple moving average, which is contributing to the current bullish momentum. The euro is also showing efforts to establish …

Read More »EUR/USD Climbs Amid US Economic Uncertainty and Shifting Eurozone Outlook

The EUR/USD pair has exhibited notable strength, climbing to near 1.0850 as the US Dollar faces mounting pressure amid growing concerns over the US economic outlook. This surge comes as investors grapple with the potential impact of US President Donald Trump’s “America First” policies, which are increasingly perceived as a …

Read More »European Markets Climb on Coalition Prospects and Stimulus Optimism

European stock markets rose on Monday as the region began the new week on a positive note amid encouraging political developments in Germany. At 03:05 ET (08:05 GMT), Germany’s DAX index gained 0.7%, France’s CAC 40 advanced 0.6%, and the UK’s FTSE 100 inched up 0.1%. Political sentiment was boosted …

Read More »European Markets Fall Amid ECB Cuts, Trade Policy Uncertainty, and U.S. Data Concerns

European stock markets sank on Friday as investors digested the latest European Central Bank (ECB) rate reduction ahead of key U.S. employment data, amid persistent uncertainty over U.S. trade policies. At 06:30 ET (11:30 GMT), the pan-European Stoxx 600 dropped 0.5%, Germany’s DAX fell 1.6%, France’s CAC 40 slipped 1.0%, …

Read More »Euro extends gains 7/3/2025

The Euro extended its gains during the previous trading session, surpassing the target of 1.0715 and reaching a high of 1.0853. Technical Outlook Bullish Support: On the 4-hour chart, the simple moving averages continue to support the daily upward trend. Intraday trading remains stable above the resistance level of 1.0715—now …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations