Flat Opening European stocks kicked off Wednesday’s trading session with little change, as declines in Deutsche Post offset gains made by companies reporting positive earnings data. The STOXX 600 index hovered around 486.57 points by 0826 GMT. Upbeat Earnings from TeamViewer TeamViewer shares surged by 10.9 percent, claiming the top …

Read More »Euro is trying to establish support 7/2/2024

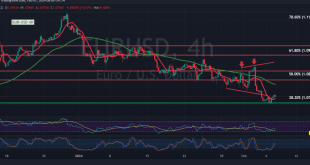

The EUR/USD pair has demonstrated resilience as it found solid support near the 1.0720 level, initiating today’s trading session with a commendable effort to rebound. Currently, the pair hovers around the critical resistance level of 1.0765, reflecting the market’s ongoing battle for direction. Technical Analysis: Mixed Signals Amidst Intriguing Dynamics …

Read More »European Stocks Rise on BP Earnings and Chinese Stimulus Hopes

European stocks opened higher on Tuesday, buoyed by positive earnings from oil giant BP and indications of fresh stimulus measures to support struggling Chinese financial markets. Key Points: Stoxx 600 Index Gains: The European Stoxx 600 index advanced by 0.27%, following a 1.3% surge in Asian stocks driven by efforts …

Read More »EUR/USD Pair Resumes Bearish Trend Amid Technical Pressures 6/2/2024

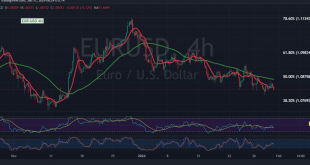

The EUR/USD pair has once again succumbed to the official bearish trend, failing to sustain trading above the crucial 1.0860 level. During the previous trading session, it reached its lowest point at 1.0715, signaling a resurgence of bearish sentiment. Technical Analysis Simple Moving Averages and Fibonacci Retracement On the technical …

Read More »European stocks open higher on positive business results

European stocks saw a positive start to the trading session on Monday, fueled by more upbeat corporate results, although investor confidence faced headwinds from global economic considerations and reassessment of interest rate expectations. Market Overview STOXX 600 Index Rises 0.2 Percent The European STOXX 600 index demonstrated resilience, rising by …

Read More »European Stocks Gain Ground on Positive Corporate Reports and Wall Street Momentum

Analysis of Market Movement and Notable Performers As the trading day commenced in Europe, stocks experienced an upward trajectory on Friday, driven by a slew of positive reports from regional companies. The European STOXX 600 index, a broad gauge of European equities, rose by 0.4 percent by 0830 GMT, signaling …

Read More »Euro is trying to recover 2/2/2024

The euro exhibited positive momentum against the US dollar, driven by the proximity to a robust support level at 1.0770, marked by the 38.20% Fibonacci retracement. Examining the 4-hour time frame chart from a technical standpoint, the mentioned support level prompted a retest of the formidable resistance at 1.0875, coinciding …

Read More »European Stock Market Faces Headwinds Amid Earnings Disappointments

As global investors navigate the intricate landscape of financial markets, European stocks faced a downward trajectory on Thursday. The European Stoxx 600 index saw a decline of 0.2 percent by 0820 GMT, with banks bearing the brunt of the negative sentiment, experiencing a notable 1.4 percent drop. This downturn was …

Read More »European Stocks Extend Gains, Awaiting US Federal Reserve Decision

European stocks continued their upward trajectory on Wednesday, marking the sixth consecutive session of gains. The financial sector played a pivotal role in supporting the positive momentum as traders eagerly awaited the US Federal Reserve’s monetary policy decision later in the day. Market Performance: As of 0822 GMT, the European …

Read More »Euro continues its gradual decline 31/1/2024

The Euro continues its downtrend against the US Dollar as anticipated in the previous technical report, reaching the initial target at 1.0810 and registering a low at 1.0812. The technical outlook remains consistent. Examining the 4-hour time frame chart, the Euro is presently consolidating below the sub-resistance level of 1.0860, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations