European Markets Witness Decline Amidst Dollar Strength and Inflation Data Anticipation European stocks commenced trading on Monday with a downturn, as dollar-denominated commodities faced diminished appeal in light of the strengthening US currency. Investors remained on edge, awaiting pivotal inflation data releases scheduled for this week in both the eurozone …

Read More »European Stocks Retreat as Dollar Strength Dampens Sentiment

European Markets Witness Decline Amidst Dollar Strength and Inflation Data Anticipation European stocks commenced trading on Monday with a downturn, as dollar-denominated commodities faced diminished appeal in light of the strengthening US currency. Investors remained on edge, awaiting pivotal inflation data releases scheduled for this week in both the eurozone …

Read More »Euro to be monitored 26/2/2024

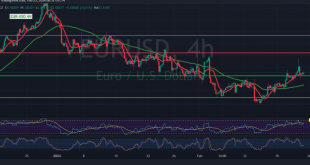

Trading in the EUR/USD pair saw a return below the pivotal resistance level of 1.0860, leading to negative movements with the pair currently stabilizing around 1.0820. From a technical perspective today, analysis of the 4-hour chart indicates that the 50-day simple moving average is exerting downward pressure, coupled with trading …

Read More »European Stocks Open Higher as Standard Chartered and BASF Results Drive Gains

: European Markets Await ECB Guidance Amidst Positive Corporate Results European stocks opened on a positive note on Friday, buoyed by robust earnings reports from companies such as Standard Chartered and BASF. However, traders exercised caution ahead of statements from policymakers at the European Central Bank (ECB), including President Christine …

Read More »Euro touches the first official target 23/2/2024

The EUR/USD pair has successfully reached the initial target outlined in our previous technical analysis, hitting 1.0860 and peaking at 1.0888. Upon examining the 4-hour chart, it’s evident that the level of 1.0860 is exerting downward pressure on the pair, prompting a potential retest of the psychological support barrier at …

Read More »European Stocks Surge to New Record High

European stocks soared to a new record high on Thursday, buoyed by a robust performance in global equities, notably with Japan’s Nikkei index reaching unprecedented levels. The European STOXX 600 index surged to 495.77 points, surpassing its previous peak of 495.46 points set in January 2022. This surge was fueled …

Read More »Euro Continues Positive Momentum 22/2/2024

In the dynamic world of forex trading, the Euro/Dollar pair maintains its upward trajectory, demonstrating quiet yet positive trading sessions. During yesterday’s session, the pair reached its pinnacle at 1.0832, showcasing a bullish stance. Technical Analysis Insights Delving into the technical analysis realm today, a closer examination of the 4-hour …

Read More »European stocks decline under the weight of disappointing business results

European stocks experienced a downturn on Wednesday, primarily influenced by a drop in banking stocks following disappointing business results from HSBC. Investors also awaited data on consumer sentiment in the euro zone, further contributing to market uncertainty. Banking Sector Leads Decline:The banking services sector witnessed a notable 1 percent decline, …

Read More »Dollar Declines Amidst Global Treasury Bond Yield Drop Rate Cut Persists

The dollar experienced a broad decline on Wednesday, influenced by a global downturn in Treasury bond yields. Traders eagerly awaited the release of the Federal Reserve’s latest policy meeting minutes, seeking insights into the central bank’s stance on interest rates. Yen Strengthens as Dollar Dips Below 150:In Asian trading, the …

Read More »Euro is trying to build an upward wave 21/2/2024

During the previous trading session, the Euro/Dollar pair witnessed predominantly positive trades, aligning with the anticipated bullish trajectory towards the official target of 1.0860. The pair reached its highest level at 1.0840, reflecting the strength of the upward movement. Technical Analysis Outlook From a technical standpoint today, examining the 4-hour …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations