Euro zone inflation unexpectedly rose in May, signaling a more protracted path towards the European Central Bank’s (ECB) 2% target. While this development is unlikely to derail the anticipated interest rate cut next week, it might prompt a pause in July and a slower pace of easing in the coming …

Read More »European Stocks Hold Steady Ahead of Eurozone Inflation Report

European stock markets experienced mixed trading within narrow ranges on Friday, as investors cautiously awaited the release of crucial eurozone inflation data, which will provide valuable insights into the future direction of global monetary policy. Early trading saw the DAX index in Germany dip 0.2%, while the CAC 40 in …

Read More »European Stocks Stabilize as Bond Markets Rebound, Focus on Inflation Data

European stock markets found some stability on Thursday as bond markets recovered from the previous day’s sell-off, which was driven by expectations of prolonged higher interest rates due to persistent inflation. The pan-European STOXX 600 index edged up nearly 0.2%, following a decline of over 1% on Wednesday. Germany’s DAX, …

Read More »European Stocks Retreat as Bond Yields Surge Ahead of Inflation Data

European stock markets experienced a broad decline on Thursday, driven by rising global bond yields, which heightened investor concerns ahead of the eagerly anticipated inflation data release at the end of the week. Early in the trading session, Germany’s DAX index fell 0.3%, the UK’s FTSE 100 dropped 0.2%, while …

Read More »EUR/USD Faces Renewed Downward Pressure 30/5/2024

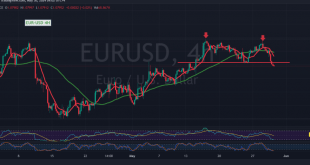

The EUR/USD pair has breached a critical support level at 1.0810, as previously highlighted in our technical analysis. This breach has triggered a wave of selling pressure, driving the pair down to a new low of 1.0790 in early trading. Examining the 4-hour chart, we observe that the euro has …

Read More »European Stocks Dip as Bond Yields Rise, Inflation Worries Weigh

European stock markets experienced a decline on Wednesday, driven by escalating bond yields that unnerved investors ahead of crucial inflation data releases. Fears of prolonged monetary tightening added to the market’s apprehension. Early in the trading session, the DAX index in Germany slipped 0.3%, while the CAC 40 in France …

Read More »Euro retests support 29/5/2024

The euro is experiencing a critical moment in its ongoing dance with the U.S. dollar. After a brief flirtation with the 1.0900 resistance level, the pair has retreated to 1.0845, leaving traders pondering its next move. A closer look at the technical landscape reveals a delicate balance between bullish and …

Read More »European Stocks Mixed as Investors Await Inflation Cues

European stock markets displayed a mixed performance on Tuesday, with the return of U.K. markets after a holiday break. Investors eagerly anticipated key inflation data from both Europe and the United States, seeking insights into the future direction of monetary policy. Early in the trading day, Germany’s DAX index edged …

Read More »EUR/USD Surges Amid Positive Technical Signals 28/5/2024

The EUR/USD pair kicked off the week with a notable surge, reaching a high of 1.0880 during today’s morning trading session. Technical Analysis Supports Upward Momentum A close examination of the 4-hour chart reveals a bullish scenario. The simple moving averages have aligned to support the prevailing daily upward trend. …

Read More »Market Drivers – US Session, May 28

Bitcoin closed on an upward trajectory, driven by news of collaboration between Argentina’s Securities and Exchange Commission and El Salvador. The two countries are exploring further adoption of cryptocurrencies. BTC’s global spread closed at $69,528 per unit, slightly higher than the previous day’s closing price of $68,489. However, the larger-cap …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations