The EUR/USD pair experienced a significant drop at the end of last week, opening this week with a downward price gap due to a strengthening U.S. dollar. The pair is currently trading around 1.0757, its lowest level in early trading today. Technical analysis on the 4-hour chart reveals a bearish …

Read More »ECB Cuts Rates, but Future Path Clouded by Inflation Uncertainty

The European Central Bank (ECB) announced a rate cut for the first time in five years, lowering the deposit rate by 25 basis points to 3.75%. However, the central bank refrained from signaling its next move due to heightened uncertainty surrounding the inflation outlook after a significant slowdown in the …

Read More »German Industrial Orders Decline Unexpectedly in April, But Signs of Recovery Emerge

German industrial orders unexpectedly contracted for the fourth consecutive month in April, primarily due to a significant decrease in large-scale orders compared to the previous month. This decline, however, was partially offset by a rise in orders excluding large-scale projects, suggesting potential signs of recovery in the sector. According to …

Read More »Euro Edges Up Ahead of ECB Rate Decision, Dollar Dips on Easing Labor Market

The euro gained slightly on Thursday as traders awaited the European Central Bank’s (ECB) policy decision, where a rate cut is widely anticipated. Meanwhile, the dollar weakened due to renewed expectations of Federal Reserve easing later this year. The Canadian dollar also saw a modest increase, recovering from earlier losses, …

Read More »European Stocks Rebound Ahead of ECB Meeting and PMI Data

European stock markets experienced a modest recovery on Wednesday, bouncing back from Tuesday’s losses, as investors eagerly awaited key regional activity data and the European Central Bank’s (ECB) latest policy meeting. The DAX index in Germany climbed 0.4%, the CAC 40 in France rose 0.5%, and the FTSE 100 in …

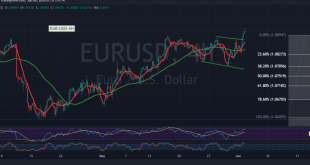

Read More »EUR/USD retest support 5/6/2024

The EUR/USD pair experienced a downturn in the previous trading session, failing to maintain its position above the key psychological resistance level of 1.0900. However, technical indicators suggest a potential rebound in the upcoming sessions. On the 4-hour chart, the simple moving averages are still providing support for the upward …

Read More »European Stocks Retreat Amid ECB Caution and US Labor Market Data Anticipation

European stock markets experienced a downturn on Tuesday, driven by investor caution ahead of the European Central Bank’s (ECB) upcoming policy meeting later in the week. As of 03:20 ET (07:20 GMT), the DAX index in Germany declined by 0.6%, the CAC 40 in France fell by the same margin, …

Read More »EUR/USD Surges Past Key 4/6/2024

The EUR/USD pair has experienced a notable surge in the early trading sessions this week, breaching the key psychological resistance level of 1.0900 and reaching a high of 1.0915. Technical analysis indicates a potential shift in momentum towards the upside. On the 4-hour chart, the simple moving averages have crossed …

Read More »European Stocks Rise on ECB Rate Cut Anticipation, Focus on US Jobs Data

European stock markets rebounded on Monday, driven by investor optimism surrounding an expected interest rate cut from the European Central Bank (ECB). Simultaneously, government bond yields decreased, while attention shifted to U.S. jobs data as a key indicator of inflation trends. The pan-European STOXX index experienced a 0.6% increase by …

Read More »Eurozone Manufacturing Downturn Shows Signs of Easing

The prolonged downturn in eurozone manufacturing activity may be nearing its end, according to a recent survey revealing a slower pace of decline in new orders compared to the past two years. This positive development has led to improved business confidence within the sector. HCOB’s final euro zone manufacturing Purchasing …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations