European markets opened cautiously on Thursday, with the pan-European STOXX 600 index holding steady. Investors are refraining from significant moves ahead of critical U.S. inflation (PCE) data due on Friday, which could influence the Federal Reserve’s interest rate decisions. Consumer price data from France, Spain, and Italy this week, as …

Read More »European Stocks Climb Amidst Anticipation for U.S. Inflation Data and French Elections

European shares advanced on Wednesday, fueled by gains in mining and technology stocks, as investors eagerly awaited the release of crucial U.S. inflation data and the outcome of the French elections later in the week. The pan-European STOXX 600 index rose 0.4% by mid-morning, with the technology sector leading the …

Read More »EUR/USD: Sideways Movement Continues, Key Levels to Watch for Breakout 26/6/2024

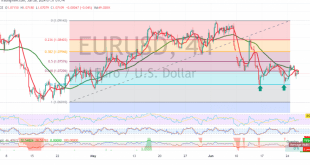

The EUR/USD pair experienced narrow sideways movement in the previous session, as we maintained our neutral stance due to conflicting technical signals. Technical Outlook: On the 240-minute chart, the pair is currently holding above the 1.0690 level and the main support level at 1.0675. This suggests the potential formation of …

Read More »EUR/USD: Conflicting Signals Warrant Cautious Approach 25/6/2024

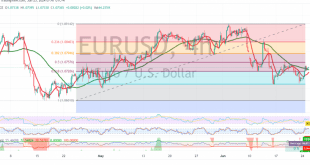

The EUR/USD pair experienced mixed trading with a negative bias in the previous session, breaking below the 1.0700 psychological support level and reaching a low of 1.0683. However, the pair has since rebounded and is currently stabilizing above 1.0700, notably holding above the 61.80% Fibonacci retracement level of 1.0720. Technical …

Read More »European Markets Hold Steady Amidst Political and Industry Shifts

A cautious mood settled over European markets on Monday, with the pan-European STOXX 600 index maintaining its position at 515.06 points. The flat opening was largely attributed to a decline in mining stocks, dragged down by weaker metal prices. However, the automotive sector provided a glimmer of hope, accelerating with …

Read More »European Stocks Dip on Tech Selloff and Carlsberg’s Failed Takeover Bid

European shares opened lower on Friday, led by a decline in technology stocks and a sharp drop in Carlsberg Group shares following the rejection of its takeover bid for British soft drinks maker Britvic. The pan-European STOXX 600 index fell 0.2% in early trading, with the technology sector experiencing a …

Read More »EUR/USD: Further Downside Expected Amid Negative Signals 21/6/2024

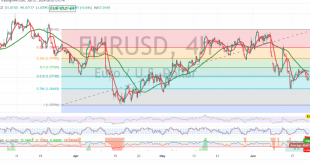

The EUR/USD pair continued its downward movement, as anticipated in our previous technical report, nearing our target of 1.0700 and reaching a low of 1.0715. Technical Outlook: On the 4-hour chart, the simple moving averages (SMAs) are maintaining their downward pressure, supporting the bearish price trend. The Stochastic oscillator has …

Read More »European Stocks Rise on Tech and Real Estate Gains, Swiss Market Boosted by Rate Cut

European shares experienced a positive trading session on Thursday, propelled by a surge in technology and real estate stocks. The pan-European STOXX 600 index rose 0.4% by mid-morning, with ASMI, a semiconductor equipment manufacturer, leading the charge in the tech sector after receiving an upgrade from Morgan Stanley. Switzerland’s benchmark …

Read More »EUR/USD: Bearish Bias Persists Amid Narrow Trading 20/6/2024

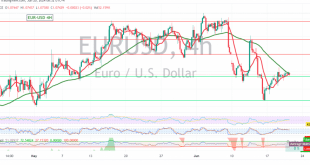

The EUR/USD pair experienced narrow sideways movement during the previous session, reflecting the subdued trading activity due to the U.S. market holiday. The overall bearish context remains intact. Technical Outlook: On the 4-hour chart, the 50-day simple moving average (SMA) continues to act as a significant barrier around the 1.0760 …

Read More »European Stocks Ease Despite UK Inflation Hitting Target; Nvidia Takes Crown as Most Valuable Company

European stock markets experienced a slight decline on Wednesday, even as UK inflation returned to the Bank of England’s target, with trading activity subdued due to a U.S. holiday. The DAX index in Germany dipped 0.2%, the CAC 40 in France also fell 0.2%, and the FTSE 100 in the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations