The EUR/USD pair is experiencing subdued trading at the start of this week, remaining below the key psychological resistance level of 1.0900. Technical Outlook: On the 240-minute chart, the Stochastic oscillator is gradually losing upward momentum, indicating a potential shift in sentiment. Additionally, the price is consolidating below the pivotal …

Read More »European Stocks Slump on Commodity and Tech Weakness, Mixed Earnings Add to Uncertainty

European shares faced a challenging day on Friday, extending their weekly losses as a combination of factors weighed on investor sentiment. The pan-European STOXX 600 index experienced a significant decline of 0.6%, reaching a two-week low, amid a widespread sell-off across various sectors. The travel and leisure sector suffered the …

Read More »European Shares Rise on Energy Gains, ECB Decision Looms

European shares experienced a modest rebound on Thursday, driven by gains in the energy sector, which offset declines in technology stocks. However, investor attention remained firmly fixed on the European Central Bank’s (ECB) impending interest rate decision. The pan-European STOXX 600 index edged 0.3% higher, breaking a three-day losing streak. …

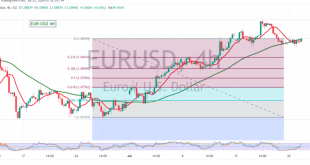

Read More »EUR/USD: Strong Bullish Momentum, Upside Potential Ahead 18/7/2024

The EUR/USD pair has continued its upward trajectory, reaching our previously identified target of 1.0950 and peaking at 1.0948, confirming the positive outlook outlined in the previous technical report. Technical Outlook: The technical outlook remains strongly bullish. On the 4-hour chart, the pair is trading within an ascending price channel, …

Read More »European Stocks Dip on ASML’s Dim Outlook and US Trade Restriction Concerns

European shares opened lower for the third consecutive day on Wednesday, primarily dragged down by Dutch semiconductor firm ASML’s disappointing forecast and apprehensions over potential stricter trade rules from the United States. Key Points: STOXX 600 Declines: The pan-European STOXX 600 index experienced a 0.3% drop, with the technology sub-index …

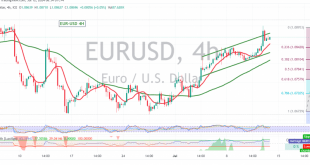

Read More »EUR/USD: Strong Bullish Momentum, Upside Potential Ahead 16/7/2024

The EUR/USD pair continued its upward trajectory, reaching our previously identified target of 1.0915 and peaking at 1.0922 during the first trading sessions of this week. Technical Outlook: The technical outlook remains strongly bullish. On the 4-hour chart, the pair is receiving sustained positive momentum from the simple moving averages …

Read More »EUR/USD: Bullish Momentum Gains Strength, Further Upside Potential 12/7/2024

The EUR/USD pair has advanced, reaching our previously identified target of 1.0880 and peaking at 1.0888, confirming the positive outlook outlined in the previous technical report. Technical Outlook: Today’s analysis reveals a strengthening bullish momentum. The pair has broken above the pivotal 1.0840 resistance level (23.60% Fibonacci retracement), which now …

Read More »Market Drivers; US Session: Focus on US Data, Potential Rate Cuts

US Dollar Dives on Soft US Inflation: The US Dollar Index (DXY) plunged to multi-week lows around 104.00 after disappointing Consumer Price Index (CPI) data and falling US yields. This data fueled speculation of the Federal Reserve cutting interest rates as early as September, sending the Dollar tumbling. Today (July …

Read More »German Inflation Eases to 2.5% in June, Confirming Preliminary Data

Germany’s inflation rate cooled down to 2.5% in June, according to the federal statistics office’s final figures released on Thursday. This confirms the initial estimates and marks a decline from the 2.8% year-on-year increase in May. The harmonized consumer price index, which allows for comparison with other European Union countries, …

Read More »European Shares Rally Amidst Corporate Earnings

European stocks saw a modest rise on Wednesday, driven by positive corporate earnings reports. However, gains were tempered by weakness in oil and metal prices, and investors remained cautious ahead of Federal Reserve Chair Jerome Powell’s second day of testimony, seeking further clues on interest rate policy. Market Performance and …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations