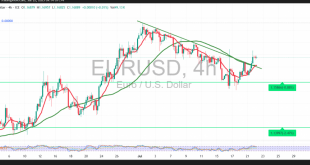

EUR/USD Technical Analysis – 4-Hour Chart The EUR/USD pair has posted solid gains in recent trading, in line with earlier bullish technical expectations. The pair successfully reached the first target at 1.1740 and approached the official target at 1.1770, recording a high of 1.1760. Technical Outlook – 4-Hour Timeframe: Price …

Read More »Is the Euro Setting Up for a Fresh Rally After Breaking the Trendline? 22/7/2025

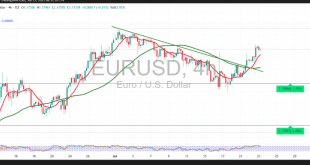

The EUR/USD pair began the week with strong bullish momentum, recording a session high of 1.1716. This move reflects a continuation of the recent upward trajectory. Technical Outlook – 4-Hour Timeframe: The pair’s rise was driven by a successful breakout above a descending trendline, reinforced by positive momentum from the …

Read More »Euro Slides Against Yen as Trade Risks and ECB Caution Dominate

The Euro weakened against the Japanese Yen, with the EUR/JPY pair trading just above 172.00, down from its multi-year high of 173.25. Escalating EU-U.S. trade tensions, led by U.S. Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent, alongside Japan’s post-election stability under Prime Minister Shigeru Ishiba, are driving market …

Read More »Euro’s Rebound Attempts Remain Limited Amid Dollar Strength 18/7/2025

As highlighted in the previous technical report, the EUR/USD pair successfully reached the bearish target at 1.1575, recording a session low of 1.1557. Technical Outlook – 4-Hour Timeframe: Intraday movements indicate limited rebound attempts, following a temporary halt in selling pressure at the 1.1575 support level. The pair is currently …

Read More »Strong Greenback Derails Euro’s Recovery Efforts 16/7/2025

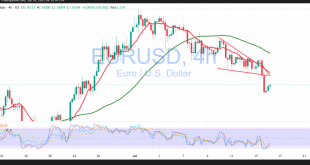

The EUR/USD pair extended its decline in the previous trading session, in line with the bearish outlook outlined in the prior technical report. The pair reached the expected target at 1.1610, recording a session low of 1.1593. Technical Outlook – 4-Hour Timeframe: Intraday price action reflects attempts at recovery driven …

Read More »Bearish Bias Dominates Euro Against USD 15/7/2025

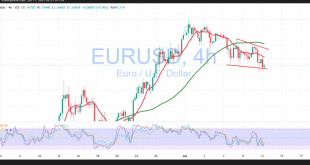

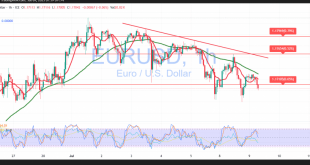

A bearish trend continues to dominate EUR/USD price action, with the pair approaching the psychological resistance level at 1.1700, which has triggered renewed negative intraday movement. Technical Outlook – 4-Hour Timeframe: The pair is currently trading below the initial resistance at 1.1685, with the simple moving averages acting as dynamic …

Read More »Bears Tighten Their Grip on the Euro: Decline May Persist 11/7/2025

The EUR/USD pair experienced bearish pressure in the previous trading session, testing key support levels and dropping as low as 1.1662. Technical Outlook – 4-Hour Timeframe: The pair is currently trading below the 1.1730 resistance level, with the simple moving averages preventing any upward movement. The Relative Strength Index (RSI) …

Read More »Dollar Dominates as Euro Retreats 9/7/2025

The EUR/USD pair has successfully activated the expected bearish scenario outlined in the previous technical report, reaching the first corrective target at 1.1690 and recording a session low of 1.1682. Technical Outlook – 4-Hour Timeframe: The technical picture continues to show bearish pressure on the pair. The 50-period Simple Moving …

Read More »Euro’s Rally Threatened by Current Resistance Level 8/7/2025

The EUR/USD pair continues to trade within a well-defined upward trajectory, edging closer to the key psychological resistance at 1.1800, with a session high recorded at 1.1790. Technical Outlook – 4-Hour Chart:Price action indicates strong resistance near the 1.1800 threshold, which has prompted some intraday pullbacks. Additionally, the 50-period simple …

Read More »Italy’s Unemployment Rate Rises to 6.5% in May Despite Job Creation

Italy’s unemployment rate saw a significant increase in May, rising sharply to 6.5% from a revised 6.1% in April, according to data released on Wednesday by the national statistics bureau, ISTAT. The increase in the jobless rate was largely attributed to a surge in the number of people who had …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations