European shares remained subdued on Friday as investors weighed the risks of an expanding conflict in the Middle East. However, strength in energy stocks helped prevent a further decline in the overall market. The pan-European STOXX 600 index held steady at 516.40 points as of 0709 GMT. Despite the resilience, …

Read More »European Stock Markets Mostly Fall Amid Middle East Conflict and Key Economic Data Awaited

European stock markets declined on Thursday as ongoing tensions in the Middle East dampened investor sentiment. Traders are also awaiting the release of key regional economic activity data, particularly services PMI reports, which could influence monetary policy expectations. By 07:05 GMT, Germany’s DAX index fell 0.4%, while France’s CAC 40 …

Read More »Euro presses support 3/10/2024

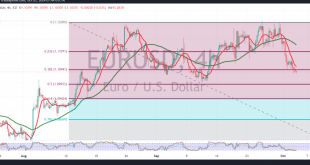

The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the …

Read More »European Stocks Edge Higher Amid Middle East Tensions, Awaiting Key Economic Data

European stock markets opened cautiously higher on Wednesday, as investors closely monitored escalating tensions in the Middle East and awaited fresh employment data from the Eurozone. Key Market Movements: Germany’s DAX: Up by 0.1%France’s CAC 40: Rose by 0.3%U.K.’s FTSE 100: Climbed 0.3% Escalating Middle East Conflict:The situation in the …

Read More »Euro Zone Inflation Falls Below 2%, Signaling Potential ECB Rate Cut

For the first time since mid-2021, euro zone inflation dipped below 2% in September, reinforcing expectations that the European Central Bank (ECB) could implement another rate cut this month as its efforts to control price growth appear to be nearing success. Key Inflation Figures: Headline Inflation: Inflation in the 20 …

Read More »Euro retests support 1/10/2024

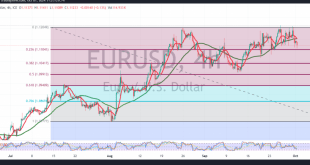

Negative trading dominated the movements of the euro against the US dollar during the first trading session of the current week, with the pair encountering a strong resistance level around the psychological barrier of 1.1200, which resulted in a bearish bias. On the technical side today, and with a closer …

Read More »European Shares Dip Amid Economic Data Focus and Auto Sector Weakness

European stocks opened lower on Monday as investors braced for a week filled with key economic data releases from the region, while awaiting remarks from European Central Bank (ECB) President Christine Lagarde. By 07:10 GMT, the pan-European STOXX 600 index had slipped 0.1% to 527.47 points. Despite this slight dip, …

Read More »Financial Markets Weekly Recap: US Data supports Fed’s inclination to more aggressive rate cut

Last week, risk assets and gold emerged as the clear winners over the dollar in the financial markets race. This was fueled by recent economic data releases from the United States, which reinforced the perception of price stability and strengthened the likelihood of continued interest rate cuts by the Federal …

Read More »European Markets Hit New Highs Amid China-Driven Rally

European stock markets reached a fresh record high in mid-morning trading on Friday, fueled by strong momentum from a rally in Asia, led by China. As of 05:13 ET (09:13 GMT), the pan-European Stoxx 600 index rose by 0.3% to 526.92, having previously hit an intraday high of 526.51. Germany’s …

Read More »Euro faces temporary hurdle 27/9/2024

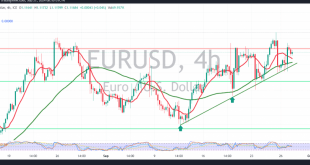

The euro experienced limited positive attempts against the US dollar, trying to break through the psychological resistance level of 1.1200, reaching a high of 1.1189. From a technical perspective today, we notice that the pair has struggled to stabilize temporarily above the 1.1200 resistance level, acting as a temporary obstacle. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations