Gold prices steadied in Asian trade on Monday as traders awaited more cues on U.S. interest rates from upcoming Federal Reserve speakers this week, while expectations of a November rate cut remained in focus. In the industrial metals market, copper prices dipped due to underwhelming signals on fiscal stimulus from …

Read More »European Markets Edge Lower Amid Mixed Economic Data and U.S. Earnings Season

European stock markets traded slightly lower on Friday, as investors digested disappointing British growth data while awaiting key U.S. bank earnings and an anticipated fiscal policy briefing from China. As of 03:10 ET (07:10 GMT), Germany’s DAX index fell 0.1%, France’s CAC 40 dropped 0.1%, and the FTSE 100 in …

Read More »Gold Extends Gains Amid Mixed U.S. Economic Data, Dollar Weakness Supports Broader Metal Prices

Gold prices continued to rise in Asian trade on Friday, building on overnight gains as stronger-than-expected U.S. inflation data was balanced by weaker labor market figures. This dynamic helped boost broader metal markets, with copper and other industrial metals benefiting from the softer dollar and anticipation of fiscal stimulus cues …

Read More »European Stocks Slip as Tech, Mining Lead Declines Amid U.S. Inflation Focus

European shares edged lower on Thursday, led by losses in technology and mining stocks, as investors awaited crucial U.S. inflation data for insights on the Federal Reserve’s next steps regarding interest rates. The pan-European STOXX 600 fell 0.2%, with the most significant declines seen in tech, mining, and travel and …

Read More »Gold Prices Steady as Dollar Strength Persists, CPI Data in Focus

Gold prices remained relatively unchanged in Asian trade on Thursday, with investors focusing on upcoming U.S. inflation data to gauge the future path of Federal Reserve interest rate cuts. A stronger U.S. dollar continued to apply pressure on gold, which has dropped from record highs due to the expectation of …

Read More »European Stocks Trade Flat Amid Middle East Tensions, China Volatility

European stock markets traded in a subdued manner on Wednesday as investor confidence was hit by ongoing conflict in the Middle East and market volatility in China. DAX (Germany): flatCAC 40 (France): down 0.1%FTSE 100 (U.K.): up 0.4% Concerns over China and Middle East Conflict European stocks were impacted by …

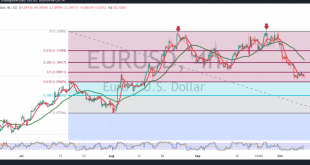

Read More »Euro holds steady below resistance 9/10/2024

The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the …

Read More »Euro Attempts to Recover Following German Data

The Euro is attempting to regain some of the ground it lost against the US Dollar in early morning trading on Tuesday, buoyed by positive economic data from Germany. This has managed to pull the Euro out of a six-day downward spiral. Germany’s industrial production index, a key indicator for …

Read More »European Stocks Fall Amid Weak Wall Street Lead and Middle East Concerns

European stock markets retreated on Tuesday, following the lead of Wall Street as investors reassessed U.S. interest rate expectations and grappled with ongoing tensions in the Middle East and regional economic concerns. By 03:05 ET (07:05 GMT), Germany’s DAX fell 0.7%, France’s CAC 40 dropped 1.2%, and the FTSE 100 …

Read More »European Stocks Slip as U.S. Jobs Euphoria Fades, Higher Bond Yields Pressure Real Estate and Utilities

European stocks edged lower on Monday as the initial optimism from strong U.S. jobs data faded, with rate-sensitive sectors like real estate and utilities feeling the impact of rising bond yields. As of 0726 GMT, the pan-European STOXX 600 index had dipped 0.2%, with real estate and utilities sectors falling …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations