The US dollar paused for breath on Tuesday, as traders awaited testimony by Federal Reserve Chairman Jerome Powell for more guidance on the recent sudden shift in central bank policy expectations. The dollar has made significant gains since the Federal Reserve indicated last week to raise interest rates earlier than …

Read More »Euro: Trying to Recover And Positivity Still Limited

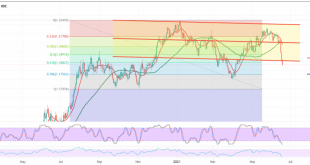

Positive attempts by the euro against the US dollar, but still limited positivity, within the euro’s attempts to restore the bullish path temporarily, benefiting from the consolidation at the 1.1880 support level. Technically, and by looking at the 60-minute chart, we find the 50-day moving average trying to push the …

Read More »The Dollar Settled After Jumping 1.9% Last Week After The Fed’s Surprise

The dollar held on to last week’s gains on Monday after the Federal Reserve surprisingly appeared to be leaning toward monetary tightening, while Bitcoin tumbled as China stepped up its crackdown on cryptocurrency mining. The dollar index was little changed after jumping 1.9% last week – the largest increase since …

Read More »Euro: Negative Pressure Remains

The bearish wave is still dominating the euro against the US dollar after slight positive movements through which the pair returned the previously broken support level 1.1880/1.1890. Technically, the bearish trend is still a valid and effective scenario, as a result of the pair continuing to obtain negative pressure coming …

Read More »The Dollar is Heading For Big Weekly Gains in Light of The US Federal Reserve’s Shift

Friday, June 18th, the dollar is set to record its best weekly performance in nearly 9 months as investors raced to consider an end to US monetary stimulus sooner than expected in the days following a sudden shift in the US Federal Reserve’s tone. Since Wednesday, when US central bank …

Read More »The Euro Extends Its Losses Against The US Dollar

The European single currency declined noticeably against the US dollar for two consecutive sessions, reaching as low as 1.1890. On the technical side, and with a closer look at the 4-hour chart, we find the current moves are showing some bullish bias but still limited. The simple moving averages continue …

Read More »EUR Extends Losses Against USD

The Euro (EUR) extended its losses against the U.S. Dollar (USD) on Thursday for the second consecutive day. This comes as the USD rose across the board following the U.S. Federal Reserve’s change in tone, expecting rising inflation and two rate hikes in 2023, sooner than previously expected. The EUR/USD …

Read More »Euro Settled Below Support And May Experience a Gradual Decline

The technical outlook is unchanged, and the pair’s movements did not change for the second consecutive session, amid quiet trading that dominated the movements of the single European currency against the US dollar. The current movements are witnessing attempts to recover, but still limited. Technically, and with a closer look …

Read More »Cautious Trading on The Dollar Due to Uncertainty About The Fed Meeting

The dollar settled near multi-week highs as traders exercise caution ahead of a two-day Federal Reserve policy meeting that is likely to hint at plans to start tapering bond purchases. So far, Fed officials led by Chairman Jerome Powell have stressed that the increase in inflationary pressures is temporary and …

Read More »Euro is Stable Below Support And Attempts to Recover Are Limited

Quiet trading dominated the movements of the single European currency against the US dollar during the previous session so that the current movements witnessed attempts to recover, but there are still limited attempts. Technically, and with a closer look at the 60-minute chart, we find that the RSI is trying …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations