The US dollar settled near a one-week low against the other major currencies on Monday, August 16th, while declining US consumer sentiment hurt bets on an early Federal Reserve monetary policy tightening, while the yuan and Australian dollar fell after disappointing Chinese economic data. There was little change in the …

Read More »Euro Trying to Recover Against The US Dollar

A noticeable surge of the euro against the US dollar at the end of last week’s trading, nullifying the expected negative outlook during the previous analysis, touching the stop-loss order 1.1800, recording the highest level at 1.1804. On the technical side today, we find the euro succeeded in stabilizing above …

Read More »The Dollar is Heading For a Second Weekly Gain, Thanks to Expectations That The Fed Will Cut Its Asset Purchases

The US dollar rose on Friday, August 13th, and is on track for a second consecutive week of gains against its major rivals, as investors assess the possibility of the Federal Reserve announcing its plans to cut stimulus in the coming weeks. Data on Thursday showed that US producer prices …

Read More »The Euro is Falling Back Against The US Dollar.

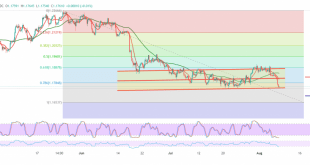

A gradual decline to the downside for the EUR/USD pair, within the expected bearish path mentioned in the previous analysis, approaching the official station of 1.1700, recording its lowest level at 1.1723. technically, and carefully looking at the 240-minute chart, we notice that the simple moving averages continue their negative …

Read More »Dollar Drops Off 4-Month High as Inflation Fears Recede

The dollar hit just under a four-month peak against major peers on Thursday as currency traders digest data from the previous day showing that US inflation may be flailing. The dollar index, which measures the performance of the US currency against a basket of six rival currencies, was unchanged at …

Read More »The Dollar is Moving Towards The Peak of The Year Before The Inflation Data

The US dollar settled at a level slightly less than this year’s peak against the euro and touched a five-week peak against the yen before US inflation data, with a high inflation rate likely to pressure the Federal Reserve to reduce stimulus policies. The dollar received a boost from strong …

Read More »Currencies Overview: The Dollar Hits a 4-Month High Against The Euro

The dollar hit a four-month high against the single European currency on Tuesday after strong US jobs data boosted expectations that the Federal Reserve will begin to scale back its massive asset purchase program. Analysts said that the dollar could be supported by higher US bond yields as the likelihood …

Read More »The Euro: May Face Negative Pressure

Negative moves still dominate the EUR/USD pair for the second consecutive session, within the expected bearish track during the previous analysis, recording its lowest level at 1.1735. Technically speaking, we maintain our negative expectations, relying on the negativity of the stochastic indicator, with the continuation of the negative pressure of …

Read More »The US Dollar Reaches Its Highest Level in Two Weeks

The US dollar index managed to maintain the rising pace that it started at the end of the last week’s trading following the release of US labor market data during the month of July, which came in a very strong way better than the market expectations and pushed the US …

Read More »The Euro is Falling Back Against The US Dollar.

The single European currency ended its weekly trading on a bearish slope, as the euro continued the descending path that started from the 1.1890 level to record its lowest level at 1.1754. On the technical side today, and with a careful look at the 4-hour chart, we find the simple …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations