The euro fell to a more than two-month low on Thursday ahead of an anticipated European Central Bank rate cut, while the dollar surged to its highest level in 11 weeks due to expectations that Donald Trump, whose policies are viewed as favorable by the market, will win the upcoming …

Read More »European Stocks Edge Up as Investors Eye ECB Rate Cut and Mixed Earnings

European stocks edged higher on Thursday, as investors anticipated a dovish tone from the European Central Bank (ECB) following its widely expected interest rate cut. The continent-wide STOXX 600 index inched up 0.1% at 0713 GMT, recovering slightly after a two-day decline. Key Gainers and Earnings Highlights Finnish bank Nordea …

Read More »Euro falls, eyes on ECB 17/10/2024

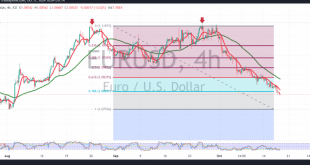

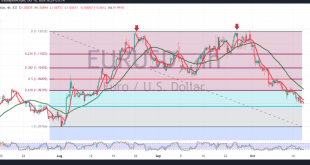

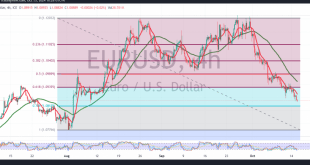

The Euro continues to decline against the US Dollar, following the expected downward trajectory as noted in the previous analysis, confirming the break of the 1.0880 level. Technical Outlook: Today’s analysis maintains a bearish outlook for the EUR/USD pair, with negative pressure driven by simple moving averages that support continued …

Read More »European Tech and Luxury Stocks Slump Amid Disappointing Earnings and ECB Caution

European tech and luxury stocks took a hit on Wednesday following weak earnings reports from key players like ASML and LVMH, adding to market jitters ahead of the European Central Bank’s (ECB) upcoming policy decision. The STOXX 600 index fell by 0.3%, pulling back further from a recent two-week high. …

Read More »Euro continues to achieve bearish targets 16/10/2024

The EUR/USD pair continued its decline, as anticipated in the previous technical report, hitting the target of 1.0880 and recording a low of 1.0878 during the morning session. Today’s analysis suggests the downward trend may persist, with negative pressure continuing from the simple moving averages, supporting the decline. The bearish …

Read More »Gold Prices Steady Near Record Highs Amid Fed Rate Cut Speculation

Gold prices remained steady near record highs during Asian trading on Wednesday, recovering some recent losses as traders continued to bet on further interest rate cuts by the U.S. Federal Reserve. After hitting record highs in September, gold has since traded within a narrow range of $2,600 per ounce, with …

Read More »Market Drivers, US Session

A mildly positive session left the US Dollar trading near recent levels. Amidst a global decline in yields, market participants remained focused on signals from Federal Reserve officials regarding the potential trajectory of interest rates.Key points for Wednesday, October 16:US Dollar Index (DXY): The DXY hovered near the upper end …

Read More »Euro confirms the break 15/10/2024

The EUR/USD pair began the week with a notable decline, aligning with the anticipated downward trajectory from the previous technical report. The pair hit the target of 1.0880, with its lowest level recorded at 1.0882 during morning trading. From a technical standpoint, on the 4-hour chart, the simple moving averages …

Read More »Market Drivers; US Session

Dollar Index (DXY) Soars, Dragging Down Major Pairs The US Dollar Index (DXY) continued its upward trajectory, breaching the 103.00 mark, driven by risk-off sentiment in the global market. Key economic indicators and speeches from Federal Reserve officials are scheduled for the day. The Euro (EUR/USD) weakened further, falling below …

Read More »European Stocks Start the Week Cautiously Amid Chinese Stimulus Talk and ECB Meeting

European stock markets opened the week on a cautious note Monday, as investors processed discussions of potential Chinese fiscal stimulus while awaiting the European Central Bank’s upcoming rate-setting meeting. As of 03:10 ET (07:10 GMT), Germany’s DAX index edged 0.3% higher, while France’s CAC 40 and the U.K.’s FTSE 100 …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations