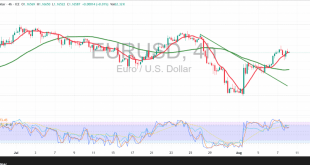

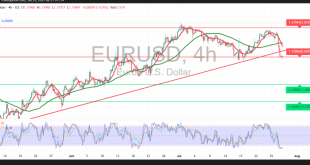

The euro continues to record gradual and quiet gains against the US dollar, approaching a breakout above the psychological barrier of 1.1700 after touching a high of 1.1697. Technical Outlook – 4-hour timeframe: Technical indicators continue to support the bullish bias, with the 50-period simple moving average acting as a …

Read More »Euro Reaches Target Level, Maintains Gains on Bullish Technicals 8/8/2025

The EUR/USD pair has successfully maintained its upward momentum, in line with our previous bullish outlook. The pair approached the first official target at 1.1700, registering a session high of 1.1698. Technical Outlook: The pair continues to show a clear bullish bias, supported by price stability above the 50-period Simple …

Read More »EUR/USD Maintains Bullish Momentum Despite Overbought Signals 7/8/2025

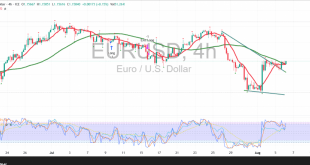

The EUR/USD pair successfully reached the bullish target at 1.1665, in line with the positive outlook presented in our previous report. The pair recorded a session high of 1.1676, confirming the continuation of its upward momentum. Technical Outlook: Price action remains steady above the 50-period Simple Moving Average (SMA), which …

Read More »Euro Regains Momentum Against the Dollar — Will the Rally Continue? 6/8/2025

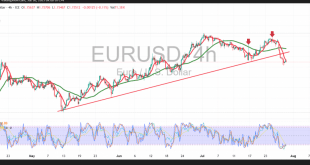

The euro is attempting to renew its bullish momentum against the U.S. dollar in early trading, after successfully holding above the key support level at 1.1525. Technical Outlook: The pair is currently trading near the session high of 1.1585. The chart indicates early signs of easing downside pressure from the …

Read More »EUR Approaches First Key Support Level: Can It Withstand the Pressure? 1/8/2025

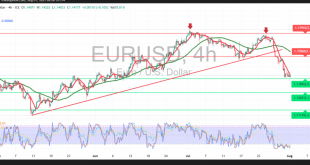

The EUR/USD pair traded within a bearish sideways range during the previous session, maintaining alignment with the prevailing negative outlook. The pair approached the key psychological barrier at 1.1400, recording its lowest level near that threshold. Technical Outlook: Currently, the pair is attempting a limited rebound to recover part of …

Read More »EUR Deepens Its Decline Versus the USD 31/7/2025

The euro continues to extend its losses against the U.S. dollar, aligning with the bearish outlook presented in previous reports. The pair reached the anticipated technical target at 1.1445 and registered a new low at 1.1405. Technical Outlook: Currently, the pair is undergoing a limited recovery attempt, aiming to retrace …

Read More »Dollar Pressure Drives the Euro into Further Gradual Decline 30/7/2025

The EUR/USD pair continues its gradual decline, aligning with the outlook presented in our previous technical report, and moving closer to the key target at 1.1510. Technical Outlook: The pair is currently trending lower after breaking below the 1.1580 support level. A closer look at the chart reveals mild bullish …

Read More »Bears Take Control of the Euro After Support Break 29/7/2025

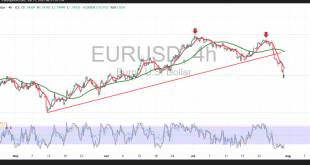

The EUR/USD pair experienced a notable decline at the start of this week’s trading, driven by strength in the US dollar, with the pair reaching a low of 1.1574. Technical Outlook: Currently, the pair is trading within a narrow range around 1.1580. A closer look at the 4-hour chart reveals …

Read More »Euro Stands Strong Amidst Global Trade Disputes

The Euro has demonstrated remarkable resilience in recent months, emerging as a top performer among major global currencies despite the ongoing backdrop of international trade disputes. Since the US President’s announcement on reciprocal tariffs earlier this year, the Euro has been the second strongest G10 currency, trailing only the safe-haven …

Read More »Noor Capital | Interview with Mohammed Hashad on Dubai TV – July 24, 2025

Commenting on Key Financial Assets: An Interview with Mohamed Hashad, Chief Strategist at Noor Capital and Member of the American Association of Technical Analysts, on Dubai TV Interviewer: Mr. Mohamed, we’ve been following the trade agreements with several countries, most notably Japan. Can it be said that Trump has indeed …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations