The euro fell to its lowest level in 4 and a half months against the U.S. dollar on Monday, as concerns about potential U.S. tariffs weighed heavily on the currency and investors reacted to growing uncertainties surrounding U.S. economic policy under President-elect Donald Trump. At 10:00 GMT, the euro was …

Read More »European Stocks Rise Amid Wall Street Momentum and Federal Reserve Rate Cut

European stock markets kicked off the week on a high note, buoyed by record gains from Wall Street and recent moves by the U.S. Federal Reserve to lower interest rates. By 03:10 ET (08:10 GMT), key indices showed robust gains: Germany’s DAX was up 1.1%, France’s CAC 40 increased by …

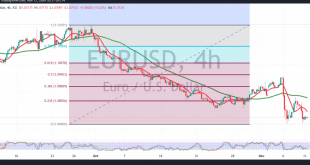

Read More »Euro awaits confirmation of break 11/11/2024

The EUR/USD pair continues to experience bearish pressure, reaching a low of 1.0667 at the end of last week’s trading session. Technical Analysis: Bearish Outlook: The simple moving averages exert downward pressure on the pair, and trading remains below the significant resistance level at 1.0785. Support Levels: A decisive break …

Read More »European Markets Slip Amid Political Turmoil and Earnings Updates

European stock markets saw modest declines on Friday, capping a week marked by political upheaval in Germany, key central bank decisions, and a fresh wave of corporate earnings reports. The early trading session reflected investor caution as markets assessed the long-term impacts of ongoing events. Market Performance: DAX (Germany): Down …

Read More »European Stocks Rise on Rebound in Tech and Resource Sectors; Rate Decisions Awaited

European markets advanced on Thursday, driven by gains in technology and resource stocks as investors turned their attention to upcoming monetary policy announcements from the Federal Reserve and the Bank of England (BoE). Key Market Highlights The pan-European STOXX 600 index climbed 0.5%, led by the basic resources sector, which …

Read More »Noor Capital | Interview with Mohammed Hashad on Dubai TV – Nov. 04, 2024

Commenting on key financial assets, in an interview with Dubai TV, Mohamed Hashad, Chief Strategist at Noor Capital and the member of the American Association of Technical Analysts, highlighted that markets are closely watching the upcoming US presidential election.Financial Assets Most Likely Affected by a Potential Trump Victory Regarding the …

Read More »European Stocks Hold Steady as Key Events Unfold Globally

European markets traded in a narrow range on Monday, reflecting investor caution at the start of a significant week that includes the U.S. presidential election, Federal Reserve and Bank of England interest rate decisions, and further corporate earnings reports. Market Overview Germany’s DAX: Down by 0.1%. France’s CAC 40: Fell …

Read More »European Markets Edge Up Amid Caution Ahead of U.S. Jobs Data and Presidential Election

European stock markets traded modestly higher on Friday morning as investors awaited the release of key U.S. nonfarm payrolls data, along with the impending U.S. presidential election. At the start of the European trading session, the DAX in Germany gained 0.2%, France’s CAC 40 rose 0.3%, and the U.K.’s FTSE …

Read More »European Stock Markets Decline Ahead of Inflation Data Release

European stock markets experienced declines on Thursday as investors assessed a wave of corporate earnings reports in anticipation of the upcoming eurozone inflation data. As of 04:05 ET (08:05 GMT), major indices reflected this trend: Germany’s DAX was down 0.8%, France’s CAC 40 fell by 0.5%, and the U.K.’s FTSE …

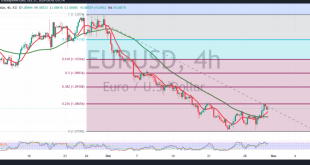

Read More »Euro holds steady below resistance 31/10/2024

The EUR/USD pair has reaffirmed its 1.0865 resistance level but failed to break through it in the last session. Technical Analysis: A closer look at the 4-hour chart shows that the 50-day simple moving average supports a potential decline, with the stochastic indicator gradually losing upward momentum. While technical indicators …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations