European shares staged a comeback on Thursday, buoyed by a strong performance in the tech sector, even as broader concerns about U.S. trade policy and France’s political instability lingered. Key Highlights Tech Sector Outperforms: The STOXX 600 index rose by 0.6% in early trading, led by the technology sector, which …

Read More »French Stocks Decline Amid Budget Concerns and Tariff Fears

French equities fell to a three-month low on Wednesday, driven by domestic political uncertainty and lingering fears over U.S. trade tariffs under President-elect Donald Trump. Broader European markets also faced pressure as investors navigated an unsettled landscape. Key Indices and Market Movement France’s CAC 40 index dropped over 1%, trailing …

Read More »European Automakers Slip Amid Trade War Concerns Over Trump’s Tariff Threats

European automaker shares faced a sharp decline on Tuesday as markets reacted to President-elect Donald Trump’s announcement of aggressive tariffs on imports from Canada, Mexico, and China. The prospect of a renewed global trade war reignited investor concerns, weighing heavily on the auto sector. Auto Sector Declines The European autos …

Read More »European Stocks Edge Higher Amid Mixed Sentiment on German Data and Corporate Moves

European stock markets started the week mostly in positive territory on Monday, buoyed by optimism around U.S. Treasury Secretary nominee Scott Bessent and major corporate news, but tempered by weaker-than-expected German business confidence data. Market Performance By 06:40 ET (11:40 GMT): Germany’s DAX rose 0.4%. France’s CAC 40 was largely …

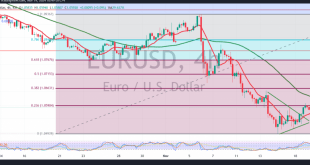

Read More »Euro tries to recover 25/11/2024

The EUR/USD pair attempted a recovery after several sessions of decline, hitting a low of 1.0330 before opening today’s trading with an upward gap. Technical Outlook: Indicators: The 4-hour chart reveals negative crossover signals from the Stochastic indicator, now in the overbought zone, coupled with continued downward pressure from the …

Read More »European Equity Markets Rise Amid Heightened Geopolitical Tensions

European stock markets opened higher on Friday as investors kept a close eye on escalating conflict between Russia and Ukraine and assessed Germany’s downwardly revised economic growth figures for Q3. Market Overview Germany’s DAX: Up 0.6% France’s CAC 40: Up 0.5% UK’s FTSE 100: Up 0.7% Geopolitical Escalation: Russia-Ukraine Conflict …

Read More »European Stocks Rebound as Technology Sector Leads Gains Amid Ukraine-Russia Developments

European markets regained footing on Wednesday, breaking a three-day losing streak, as technology stocks surged and safe-haven demand eased amidst renewed focus on geopolitical and economic developments. The pan-European STOXX 600 rose 0.5% as of 09:20 GMT, recovering from a three-month low touched on Tuesday. Major indices in Germany, France, …

Read More »Geopolitical Tensions and Inflation Concerns Weigh on European Stocks

Europe’s main stock index dropped to a three-month low on Tuesday as investor sentiment soured amidst escalating geopolitical risks and inflationary concerns linked to U.S. policies under President-elect Donald Trump. The pan-European STOXX 600 index fell 0.9%, on track for its third consecutive day of losses. Safe-haven assets, such as …

Read More »Euro retests resistance 19/11/2024

The Euro made some gains against the US Dollar during the previous trading session, attempting to retest the psychological barrier resistance level at 1.0600. From a technical standpoint, the pair is currently hovering around this resistance, which aligns with the 23.60% Fibonacci correction on the 4-hour chart. The Stochastic indicator …

Read More »European Shares Decline Amid Real Estate and Tech Weakness; Investors Eye ECB Guidance

European shares slipped on Monday, marking further losses in the wake of recent setbacks. The STOXX 600 index dropped 0.2% by 0909 GMT, extending concerns from a four-week losing streak. This decline, the longest in 2.5 years, was fueled by disappointing earnings, rising Treasury yields, and uncertainty over U.S. President-elect …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations