European stocks hovered near six-week highs on Monday, buoyed by gains in mining and luxury sectors following signs of stimulus measures aimed at reviving China’s slowing economy. Market Overview The pan-European STOXX 600 index edged up 0.1% by 1000 GMT, extending its rally to an eighth consecutive session. However, Germany’s …

Read More »Euro seeks additional momentum 9/12/2024

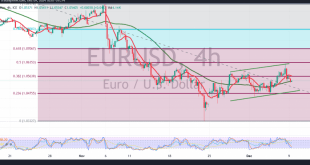

The EUR/USD pair ended last week’s trading on a bullish note, surpassing the 1.0560 resistance level and reaching the target of 1.0635, marking its highest level at 1.0635. Technical Analysis: Momentum Indicators: The 240-minute chart shows support from the 50-day simple moving average, alongside the Stochastic indicator signaling positive momentum, …

Read More »European Shares Flat Ahead of U.S. Payrolls Data; French Political Developments in Focus

European stock markets showed little movement on Friday, as investors awaited the release of U.S. nonfarm payrolls data, a critical factor in shaping Federal Reserve policy expectations for the coming months. Ongoing political shifts in France and South Korea also remained under watch. Market Highlights: STOXX 600: Down 0.04% by …

Read More »European Stocks Near One-Month Highs Amid French Political Developments

European equities remained steady on Thursday, approaching one-month highs, as French markets absorbed the political upheaval following a no-confidence vote that ousted Prime Minister Michel Barnier’s government. Market Highlights STOXX 600: Rose 0.1%, marking its sixth consecutive session of gains. France’s CAC 40: Mirrored regional trends with a 0.1% uptick. …

Read More »Euro loses momentum 5/12/2024

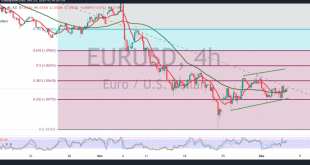

The EUR/USD pair showed a modest upward trend, benefiting from the support level of 1.0470, and reached a session high of 1.0544 during the previous trading day. Technical Analysis: The pair struggled to break the critical resistance at 1.0540, as noted in the previous analysis. On the 4-hour chart, the …

Read More »European Markets Steady Ahead of French No-Confidence Vote

European equities opened Wednesday on a cautious note as investors awaited a decisive no-confidence vote in France’s Parliament, a move that could potentially unseat Prime Minister Michel Barnier’s government. Market Overview The pan-European STOXX 600 index edged up 0.1% by 0810 GMT, marking its fifth consecutive session of gains after …

Read More »Euro is looking for a movement signal 4/12/2024

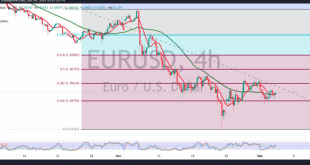

Narrow sideways trading dominates the movements of the euro against the US dollar, confined from below above 1.0480 and from above without resistance 1.0510. On the technical side today, and with a closer look at the 4-hour chart, we find that the simple moving averages still support the possibility of …

Read More »European Markets Open Higher Amid French Political Uncertainty

European stock markets showed modest gains on Tuesday morning, despite growing political challenges in France that could impact investor sentiment. Market Performance Germany’s DAX index rose 0.5%. France’s CAC 40 increased by 0.8%. UK’s FTSE 100 advanced by 0.4%. This positive momentum comes as investors balance economic data releases and …

Read More »Europe Contracts While China’s Recovery Gains Momentum

Manufacturing activity displayed stark regional contrasts in November, with European output plunging further into contraction while China saw its manufacturing sector extend its recovery, driven by government stimulus and export demand. Europe’s Manufacturing Struggles Deepen The HCOB euro zone Manufacturing PMI dropped to 45.2, signaling persistent contraction in the sector. …

Read More »Euro Continues to Decline Ahead of European Inflation Data

The euro ended Thursday’s trading on a downward trend, affected by pressure from the rising US dollar and anticipation of eurozone inflation data, which is expected to shed more light on the European Central Bank’s future monetary policy path.The EUR/USD pair fell to 1.0551 compared to the previous day’s close …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations