Japanese stocks closed lower on Tuesday as tensions escalated between Beijing and Washington ahead of a possible visit by US House Speaker Nancy Pelosi to Taiwan on Tuesday. At the same time, the yen’s rally against the dollar fueled a sell-off in exporters’ shares. The Nikkei index fell 1.42 percent …

Read More »Euro looking for more momentum 2/8/2022

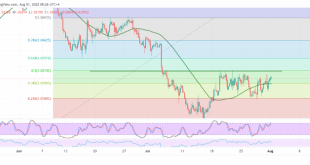

Quiet trading tilted to the positive, dominating the euro’s movements against the US dollar within the expected bullish path during the previous report, touching the first awaited target at 1.0275, recording the highest level at 1.0293. On the technical side, today, we find the bullish scenario still valid, relying on …

Read More »European shares stabilize amid fears of recession, despite positive results

European shares settled on Monday ahead of a slew of manufacturing activity data, as disappointing Chinese economic data raised fears of a global economic slowdown while erasing a jump in banking shares after strong HSBC results. The pan-European Stoxx 600 index settled at 7:09 GMT, tracking the effect of the …

Read More »Japan shares post biggest gains in nearly two weeks thanks to positive results

Japanese stocks had their best day in nearly two weeks on Monday, boosted by positive corporate results, while uncertainty over the global growth outlook kept gains limited. The Nikkei rose 0.7% to close at 27,993 points, and the broader Topix index rose 1 percent to 1960 points, their biggest gain …

Read More »Euro is looking for more bullish momentum 1/8/2022

The euro showed upward movements against the US dollar, which continued its descending correction to its lowest level in 3 weeks to record the highest level last Friday at 1.0254. Today’s technical vision indicates the possibility of continuing the bullish bias due to the positive motive coming from the 50-day …

Read More »Eurozone Preliminary Inflation surges 8.9% YoY in July

The annualized Eurozone Harmonised Index of Consumer Prices (HICP) accelerated by 8.9% in July vs. June’s 8.6%, the latest data published by Eurostat showed on Friday. The market consensus was for an 8.6% figure. The core figures rose to 4.0% YoY in July when compared to 3.8% expectations and 3.7% …

Read More »Yen is heading for the largest weekly gain in 4 months against USD

The Japanese yen rose on Friday, set for its biggest weekly gain in four months against the dollar on bets that US interest rates are nearing a peak after data on Thursday showed that the world’s largest economy unexpectedly contracted in the second quarter. Futures markets expect US interest rates …

Read More »European shares set for best month since November 2020 thanks to strong earnings

European shares rose on Friday, set for their first monthly gain in four months as solid corporate earnings overshadowed global recession fears. Meanwhile, the focus now turned to eurozone inflation and gross domestic product data due later on Friday. The pan-European STOXX 600 index rose 0.7 percent by 0715 GMT, …

Read More »Yen, Swiss franc draw safe-haven flows on US recession news

Volatility erupted in the forex market after the US officially entered a technical recession in the second quarter of 2022 and Europe’s energy crisis keeps inflation sticky high. This development followed the Fed’s second consecutive 75-basis-point interest rate hike, for the first time since early 1980s.Today, currency flows shifted to …

Read More »statements of FED support European stocks

European shares rose to a seven-week high on Thursday as some concerns about the pace of the Federal Reserve’s rate hike dissipated while strong business results for companies, including Shell, supported buying. And the Federal Reserve (the US central bank) raised the interest rate by 75 basis points, as expected, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations