European stock markets ended the week on a downbeat note as concerns about a potential trade war with the U.S. and disappointing economic data weighed on investor sentiment. Indices Under Pressure Germany’s DAX dropped 1.1%, France’s CAC 40 slid 1%, The UK’s FTSE 100 fell 0.4%. Trade Tensions Escalate with …

Read More »Fed’s Hawkish Tone Weighs on Euro

The Euro weakened significantly against the US Dollar after the Federal Reserve’s interest rate decision and subsequent press conference. While the Fed delivered a 25 basis point rate cut as expected, the central bank’s cautious tone and economic projections dampened market sentiment for the Euro.Key takeaways from the Fed’s decision:Rate …

Read More »EUR/USD Stalls Near 1.0500 Ahead of Fed Decision

The EUR/USD pair is trading near 1.0500 on Wednesday, struggling to gain significant momentum. The 20-day Simple Moving Average (SMA) at 1.0550 continues to cap upside potential, suggesting a cautious market sentiment.Technical AnalysisTechnical indicators point to a lack of directional bias. The Relative Strength Index (RSI) is hovering around 42, …

Read More »European Markets Mixed Amid Fed Anticipation and Corporate Developments

European markets displayed a mixed performance on Wednesday as investors turned their focus to the upcoming U.S. Federal Reserve decision. By mid-morning, Germany’s DAX slipped 0.1%, France’s CAC 40 remained unchanged, while the U.K.’s FTSE 100 edged up 0.2%. Market participants are widely expecting the Fed to announce a 0.25% …

Read More »Euro on sideways track 18/12/2024

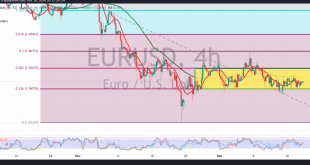

The EUR/USD pair continues to exhibit narrow sideways trading, confined between support at 1.0470 and resistance at 1.0560. From a technical standpoint, the pair remains under pressure below the 50-day simple moving average, reinforcing the likelihood of a bearish continuation. This is further supported by the negative signals from the …

Read More »Europe’s Labour Market Shows Signs of Cooling, Easing Inflation Pressures

Europe’s labour market softened in the third quarter, with data on Monday indicating a decline in inflationary pressures, potentially paving the way for further interest rate cuts. Labour cost growth in the eurozone slowed to 4.6% in Q3, down from 5.2% in the previous quarter, according to Eurostat. Meanwhile, the …

Read More »Euro awaits negative stimulus 16/12/2024

The EUR/USD pair experienced negative trading towards the end of last week’s sessions, exerting pressure on the support level of 1.0470 and recording a low of 1.0453. Technically, the pair is showing attempts at a bullish bounce due to its temporary stability above the strong support at 1.0470. However, the …

Read More »ECB’s Rate Cut Weighs on Euro, but Technicals Hint at Potential Rebound

Euro Under Pressure, But a Technical Rebound LoomsThe Euro has been grappling with downward pressure following the European Central Bank’s (ECB) decision to cut interest rates. The EUR/USD pair, a key currency market indicator, has hovered near the 1.0500 level, suggesting a delicate balance between bearish and bullish forces.Technical Analysis …

Read More »European Stocks Decline as Investors Weigh Economic and Policy Uncertainties

European stock markets edged lower on Friday, poised to end a three-week winning streak as investors sought clarity on the euro zone’s monetary easing trajectory and grappled with concerns about slowing economic growth and rising geopolitical risks. The pan-European STOXX 600 index dipped 0.1%, setting it up for a 0.3% …

Read More »Euro Weakens as ECB Cuts Rates, US Dollar Gains Strength

ECB’s Dovish Stance Weighs on the EuroThe European Central Bank (ECB) has once again cut interest rates by 25 basis points, signaling a continued dovish stance. This move, aimed at stimulating economic growth and combating deflationary pressures, has weakened the Euro. Additionally, ECB President Christine Lagarde’s acknowledgment of discussions regarding …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations