Quiet trading tended to be negative, dominating the movements of the euro-dollar pair at the end of last week’s trading during the Thanksgiving holiday, to witness the current movements of the euro-dollar stabilizing around the lowest level during the early trading of the current session 1.0350. Technically, by looking at …

Read More »European stocks are falling

European stocks fell on Friday as retailers came under pressure following the start of the holiday shopping season amid fears of a sharp slowdown in the global economy and a sharp rise in inflation. The Stoxx 600 index was down 0.1% by 0811 GMT, below a three-month high hit earlier …

Read More »Japan’s Nikkei closes lower, but records a weekly jump

Japan’s Nikkei average closed lower on Friday, after hitting a more than two-month high in the previous session, as investors sold shares of chip-related technology and growth companies to lock in gains. Still, losses were limited by hopes of a slowdown in rate hikes globally. The Nikkei index fell 0.35 …

Read More »December could be Euro’s best month

The average monthly performance of the Euro against the US dollar for the last 20 years shows that the EUR/USD pair usually rises in December according to several economists. The last 20 Decembers are seen as perfect time for the EUR/USD to rise on 16 occasions out of the total …

Read More »European stocks are looking for direction

European stocks opened little changed on Thursday, November 24th, after the minutes of the Federal Reserve meeting indicated a moderation in the pace of interest rate hikes and while investors await new indications from the European Central Bank. The Stoxx 600 index of European shares fell 0.03% amid low trading …

Read More »The US dollar is declining as risk appetite improves after the Fed

The US dollar fell Thursday, November 24, as investors flocked to risky assets after expectations of a slowdown in the rate hike in the US. The upcoming minutes of the Fed’s Monetary Policy Committee meeting, which was held on the first and second of November, revealed that officials are very …

Read More »The Nikkei index closed at a two-month peak amid hopes of a slowdown in interest rate hikes in the US

Japan’s Nikkei index ended Thursday’s trading at its highest level in more than two months, tracking Wall Street, which posted overnight gains on hopes that the Federal Reserve will slow the pace of interest rate hikes. The Nikkei index closed up 0.95 percent at 28,383.09 points, the highest level since …

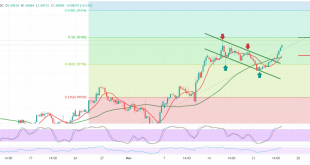

Read More »Euro touches targets and positivity remains 24/11/2022

A positive trading session that witnessed the movements of the Euro-dollar pair within the expected bullish path during the last analysis, explaining that the breach to the upside and the consolidation above the resistance level of 1.0350 is a motivating factor that enhances the chances of touching our required target …

Read More »Dollar is stable ahead of Fed

The US dollar held steady on Wednesday ahead of the highly anticipated release of the Federal Reserve’s latest policy meeting, while the New Zealand dollar was boosted by a record interest rate hike to curb inflation. The US dollar index, which measures the dollar’s performance against six major currencies, settled …

Read More »European shares hover near a 3-month high

European stocks hovered near three-month highs on Wednesday as a rally in commodities stocks offset a decline in Credit Suisse after issuing a profit warning, while investors awaited corporate activity data for clues to the strength of the eurozone economy. By 0805 GMT, the pan-European Stoxx 600 index was flat …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations