The US dollar index held firm on Tuesday, posting its biggest gain in two weeks, after strong US service sector data fueled expectations that the Federal Reserve would raise interest rates more than recently expected. The Australian dollar rose from near a one-week low after the Reserve Bank of Australia …

Read More »European stocks are falling under pressure from the banking and energy sectors

European stocks fell on Tuesday, December 6, under pressure from the banking and energy sectors, as strong data on the services sector activity in the United States raised fears that the US Federal Reserve will continue to raise interest rates at large rates. The Stoxx 600 fell by 0.1%, extending …

Read More »Japanese stocks closed higher, supported by chip stocks and exporters

Japanese stocks ended slightly higher on Tuesday, supported by gains in chip-related stocks as well as exporters, which rose on the back of the yen’s decline against the dollar. The Nikkei index increased 0.24 percent, closing at 27,885.87, while the Topix index rose 0.12 percent, closing at 1950.22. The dollar …

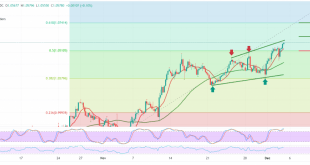

Read More »Euro retesting support 6/12/2022

Little negativity dominated the movements of the EUR/USD pair as a result, after it witnessed substantial gains last Friday, heading to the downside due to the price approaching the resistance level of the psychological barrier 1.0600. On the technical side, the support levels published in the previous technical report at …

Read More »European stocks fell ahead of data

European stocks fell on Monday in cautious trading ahead of the publication of data on business activity amid concerns about the economic slowdown in the European Union. Stocks posted gains for the seventh consecutive week on Friday, supported by China’s easing of COVID-19 restrictions following protests against the country’s strict …

Read More »Dollar is falling after easing of Corona restrictions in China boosted risk appetite

The dollar fell broadly on Monday after a difficult week, dropping below seven yuan as sentiment towards riskier assets improved after signs that China would ease some restrictions related to COVID-19. More Chinese cities, including financial hub Shanghai and Urumqi in the far west, announced easing coronavirus restrictions over the …

Read More »Japanese Nikkei index closed higher

Japan’s Nikkei index closed slightly higher on Monday, supported by gains in Fast Retailing, owner of Uniqlo stores, and technology heavyweights. The Nikkei index rose 0.15 percent to close at 27,820.40 points, while the broader Topix index fell 0.31 to 1,947.90 points. In the US, the S&P 500 and the …

Read More »Euro continues the bullish against USD 5/12/2022

The euro-dollar pair jumped to the top, achieving strong gains. However, as a reminder, we indicated during the last technical report that the resumption of the rise depends mainly on confirming the pair’s breach of the resistance level of the psychological barrier 1.0400, to target 1.0520, recording its highest level …

Read More »European stocks are heading for gains for the seventh week

European stocks seem to be heading for gains for the seventh week in a row amid easing fears of tightening monetary policy globally. However, stocks fell on Friday ahead of the release of US jobs data. The pan-European Stoxx 600 index fell 0.5 percent after two days of strong gains. …

Read More »European stocks rise, supported by Powell’s speech and hopes of easing restrictions in China

European stocks rose to their highest levels in three months on Thursday, supported by the Federal Reserve chairman’s indication that the pace of rate hikes will be lowered, as well as China’s softening of its rhetoric on strict anti-Covid-19 rules. The Stoxx 600 was up 0.9% by 0810 GMT, after …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations